Carvana, CRH & Comfort Systems Set to Join the S&P 500, What It Means and Why Their Stocks Are Soaring?

What’s Going On S&P 500 Rebalance and New Additions

Every few months, the S&P 500 index widely used as a benchmark for U.S. equities is rebalanced. That means some companies are removed, others added, to reflect changes in market capitalization, liquidity, and eligibility criteria.

In the upcoming rebalancing, the index committee has reportedly selected three new names Carvana, CRH plc, and Comfort Systems. That means these firms will replace some outgoing members (not yet publicly confirmed) and become part of the elite 500-stock list.

For institutional investors, ETFs, mutual funds, and index funds tracking the S&P 500 that automatically prompts forced buying of the new constituents, often resulting in a sharp stock price move even before actual inclusion.

That dynamic helps explain why markets responded with enthusiasm particularly for Carvana, whose stock reportedly soared after the announcement.

Why These Companies and What They Bring to the Index

Carvana

Once a high-growth, sometimes controversial online used-car retailer, Carvana’s inclusion signals the index sees renewed stability or at least sufficient size and liquidity. Even if the company faces headwinds, being in the S&P 500 tends to attract institutional capital, which can improve trading volumes and volatility profiles.

CRH plc

CRH is a global building materials company. Its inclusion may reflect broader macroeconomic optimism the outlook for infrastructure, construction, and global growth. A diversified multinational in the index may help balance S&P 500’s tech-heavy bias.

Comfort Systems USA, Inc.

Comfort Systems is a building-services / HVAC-services firm. Its presence suggests S&P 500 is expanding its industrial and services representation. It may appeal to investors seeking exposure to stable, recurring-service-based earnings rather than high-volatility tech or growth stocks.

In other words the rebalancing isn’t just mechanical it reflects the evolving U.S. (and global) economy putting more weight on services, infrastructure, and cyclical industries over the high-flying growth / tech stocks that dominated past decades.

What Inclusion Means For the Stocks, the Companies, and Investors

1. Forced inflows from passive funds

Funds tracking the S&P 500 must buy shares of the new entrants to match the index. This typically drives a short-term price spike.

2. Improved liquidity and lower volatility risk

S&P 500 membership tends to make a stock more liquid, perhaps reducing bid-ask spreads and volatility, especially for institutional flows.

3. Higher scrutiny and more analyst coverage

Index membership leads to more institutional interest, deeper analyst coverage, and possibly improved corporate communications and governance standards.

4. Pressure to perform

With a higher-profile listing, investors will expect consistent performance. Companies like Carvana may face increased pressure to improve transparency, earnings consistency, and long-term viability.

5. Diversified exposure for index funds and pension funds

For large funds seeking diversified exposure, additions like CRH and Comfort Systems may help balance the index’s overall risk providing industrial & services coverage alongside tech.

Why the Timing Matters Macro, Market, and Economic Signals

This rebalancing comes at a moment of broad economic uncertainty. Inflation, interest-rate pressure, shifting consumer behavior, and global supply-chain stress make many investors cautious.

By adding companies less dependent on high-growth hype and more tied to real-world demand construction, services, material goods, used auto market the S&P 500 may be signaling a shift in sentiment: from fast-growth, high-volatility tech to real-economy, cash flow, cyclicals, and services.

For investors, that may mean the next bull cycle will look different more grounded, more tied to global demand, less about speculative future earnings.

What Could Go Wrong Risks to Watch

- Forced buying is short-term long-term performance still matters. If Carvana or Comfort Systems underperform, the initial “index premium” can evaporate quickly.

- Valuation resets Inclusion often pushes valuations higher; a bad earnings season then hurts more.

- Economic cycles Firms tied to construction or consumer goods (like CRH or Carvana) remain vulnerable to recessions or consumer spending slowdowns.

- Regulatory / macro headwinds Rising interest rates, credit tightening, inflation all could hurt cyclical businesses more than stable growth firms.

What Investors Should Do Now Strategy Tips

- Watch volumes The next few weeks will see elevated trading as funds rebalance. Smart investors might wait for post-rebalance dips to enter, rather than chase the spike.

- Evaluate fundamentals Don’t buy just because a stock enters the index. Study earnings, debt, market conditions, and long-term viability.

- Diversify With the index shifting slightly toward cyclicals and services, consider balancing with growth-oriented or stable dividend stocks.

- Monitor macro signals Interest rates, consumer demand, construction leads these will now matter for parts of the S&P 500 more than before.

A New Chapter for the S&P 500 and a Different Kind of Bull Market

The upcoming rebalancing is more than just a technical shuffle. It reflects a subtle but important shift in how capital allocates in uncertain times.

By adding companies like Carvana, CRH, and Comfort Systems, the world’s pre-eminent index may be preparing for a different kind of rally one driven not by narratives or tech hype, but by real-world demand, service cycles, and tangible economic activity.

For investors, this could be a chance to recalibrate: to look beyond growth mania and find value in stability, liquidity, and real-economy exposure.

The question now isn’t just who’s in the index it’s what kind of economy the index believes is coming next.

TLAS OPINION The Rebalance That Reveals the Market’s Next Obsession

TLAS OPINION The Rebalance That Reveals the Market’s Next Obsession

The S&P 500’s decision to add Carvana, CRH, and Comfort Systems is more than a quarterly reshuffle it’s a confession. A confession that Wall Street is quietly preparing for a new era where AI hype is no longer enough, liquidity matters again, and real-world industries are regaining dominance.

Carvana’s inclusion is the shockwave. A company once written off as a pandemic bubble is now being treated like a comeback story worthy of America’s most prestigious index. The market isn’t cheering the company it’s cheering the narrative of resurrection.

CRH’s rise feels like a nod to infrastructure’s global resurgence. When the world’s biggest economies pour trillions into rebuilding roads, rails, ports, and energy systems, building-material giants become the silent titans behind the scenes.

And Comfort Systems? Its addition is a sign that investors are rediscovering the value of boring businesses that print cash HVAC, building services, maintenance. Stable, essential, profitable.

If the S&P 500 is the mirror of the American market psyche

This rebalance suggests the next bull run won’t be led by dreams.

It will be led by demand, construction, services, and hard assets.

This is not a rotation.

This is a replacement of priorities.

FAQs

1. Why is the S&P 500 adding companies that aren’t traditional tech or AI giants right now?

Because the index committee anticipates a broader shift in capital flow. When tech overheats, the S&P strengthens its foundation with industrial, cyclical, and service-sector names to stabilize long-term index performance.

2. Does Carvana’s inclusion mean the used-car tech model is now considered “mature”?

Not exactly but it means Carvana has achieved enough liquidity and scale that index funds can safely hold it without risking volatility spillover into the benchmark.

3. Could CRH’s addition indicate infrastructure stocks becoming the next mega-cap trend?

Yes. Several global funds have begun reallocating toward long-horizon infrastructure plays, anticipating multi-decade government spending cycles.

4. Why is Comfort Systems suddenly being treated as a growth company?

Because maintenance, HVAC, and building services have become “unintentionally essential” in the age of data centers, AI compute facilities, and high-energy-consumption buildings.

5. Do new S&P 500 companies lose the “inclusion premium” later?

Yes historically, many experience a pullback 2–6 weeks post-inclusion once index funds finish their mandatory buying.

Table of Contents

- Global Markets on Edge- Tech Selloff, Fed Fears, and Iran Tensions Shake Investors-“But Opportunities Are Emerging. (Feb 2026)

- Milano Cortina 2026 Opens With Stunning and With Historic Opening Ceremony- But Critics Question Costs, Climate Impact or as the World Faces Division

- IRS Tax Refund 2026- Bigger Payments Coming for Some, but Delays Loom as Staffing Crisis Deepens

- Marvel’s Wolverine Has Massive Hype – But! Can Insomniac Really Deliver Its Darkest Game Yet? (Feb 2026)

- Fallout Countdown Falls Flat – “This Wasn’t What We Expected’ Fallout Countdown Backlash Erupts Online (Feb 2026)

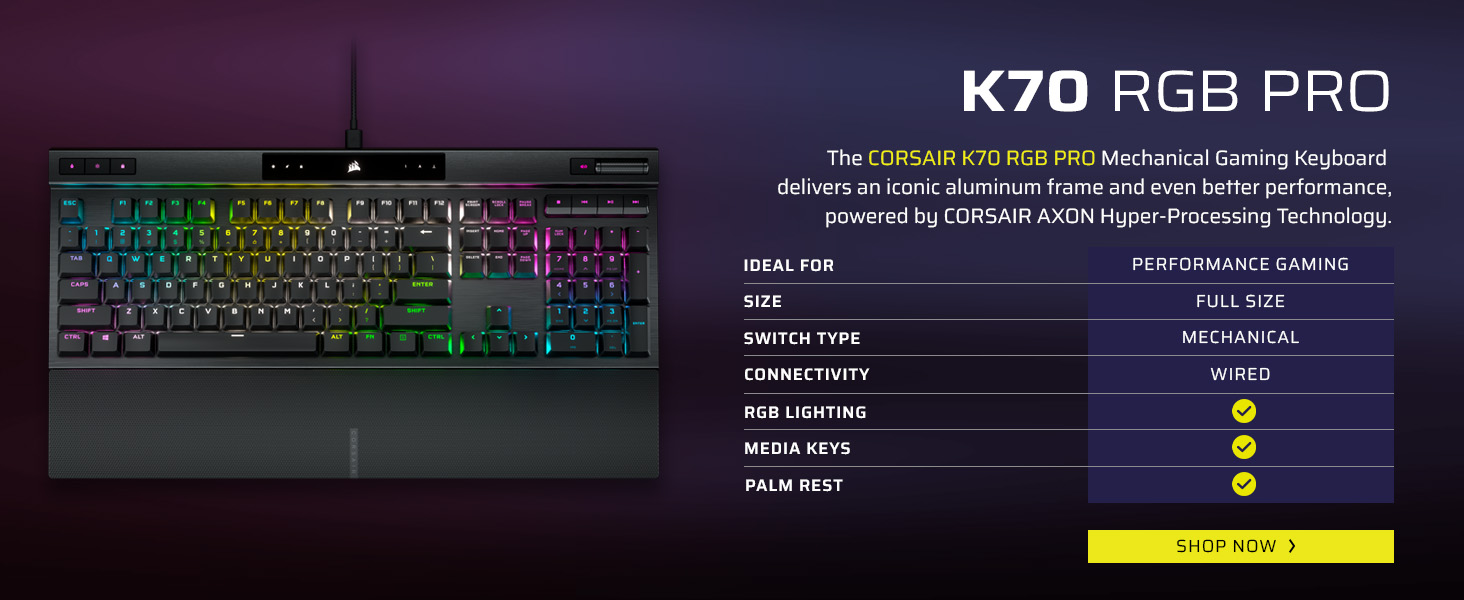

Corsair K70 PRO TKL RGB

Corsair K70 PRO

About this item

- Speed is Everything: It’s all about speed. With Rapid Trigger, ultra-fast polling rates, and per-key adjustable switches, K70 PRO TKL removes every barrier that comes between you and gaming greatness

- Space-Saving Tenkeyless Layout: The sleek, streamlined tenkeyless layout fits in nearly every gaming setup, while leaving room for sweeping mouse movements

- MGX Hyperdrive Magnetic Switches*: Pre-lubricated CORSAIR MGX Hyperdrive magnetic switches deliver a smooth, ultra-responsive keypress. Its sturdy double-rail structure reduces wobble and guarantees peak performance for 150 million keystrokes. *Function keys and non-primary keys feature CORSAIR MLX switches

- Rapid Trigger Advantage: Rapid Trigger dynamically changes your keys’ actuation and reset points, so you can move and reset your movements faster than ever

- Customizable Per-Key Actuation: Adjust the actuation point of each key from a super-sensitive 0.4mm to a deep 3.6mm (in 0.1mm steps) or set two actions to a single keypress with dual actuation for quick-fire combos and action pairs.

Leave a Reply