Australia’s Energy Reset Why Origin Energy and AGL Are Courting Private Capital for Billions in Green Assets

Australia’s energy sector is entering a decisive new phase. As the country accelerates its transition toward renewables, Origin Energy and AGL two of the nation’s largest power players are actively courting private capital to fund billions of dollars’ worth of green energy assets.

This shift isn’t just about sustainability. It reflects a deeper capital discipline reset across the ASX 200 energy sector, as companies look for smarter, less risky ways to finance the energy transition without crushing shareholder returns.

The Big Shift Why Energy Giants Are Turning to Private Capital

Traditionally, large utilities funded infrastructure through balance sheets, debt, or equity raises. That model is now under pressure.

Renewable projects:

- Require massive upfront capital

- Deliver long-term, lower but steadier returns

- Carry construction, regulatory, and grid risks

By partnering with private equity, infrastructure funds, and sovereign investors, companies like Origin Energy and AGL can:

- Share financial risk

- Unlock capital faster

- Protect dividend stability

- Keep leverage under control

This approach mirrors global energy markets, where private capital is increasingly funding the clean energy boom.

Origin Energy Unlocking Value from Green Assets

Origin Energy has been exploring ways to monetize and partially divest renewable assets while retaining operational influence.

What Origin Is Targeting

- Wind farms

- Solar projects

- Battery energy storage systems (BESS)

- Future renewable development pipelines

Rather than selling outright, Origin is believed to be considering:

- Minority stake sales

- Joint ventures

- Asset-level partnerships

This allows Origin to:

- Recycle capital into new projects

- Improve return on equity

- Reduce balance sheet strain

AGL’s Renewables Fund A Strategic Pivot

AGL is reportedly evaluating the creation of a dedicated renewables fund, potentially seeded with its own assets and backed by external investors.

Why a Renewables Fund Makes Sense

- Separates legacy thermal assets from green investments

- Attracts ESG-focused institutional capital

- Improves transparency for investors

- Accelerates coal exit plans

AGL’s move reflects a clear strategic pivot: renewables are no longer just an environmental obligation they’re a financial structure problem that needs innovative solutions.

ASX 200 Energy Reset Capital Discipline Takes Center Stage

Across the ASX 200, energy companies are becoming more selective and disciplined.

What’s Changed

- Fewer mega debt-funded projects

- More partnerships and co-investments

- Higher scrutiny on returns

- Stronger alignment with long-term cash flow

Investors are no longer rewarding aggressive expansion. Instead, markets prefer:

- Predictable earnings

- Controlled risk

- Transparent funding models

This reset signals a maturing renewables market less hype, more financial realism.

Why Private Capital Is So Interested in Green Energy

Private capital sees renewable infrastructure as:

- Inflation-resistant

- Long-duration

- Government-supported

- Aligned with global decarbonization goals

Superannuation funds, sovereign wealth funds, and infrastructure investors are hunting for:

- Stable yields

- ESG-compliant assets

- Long-term growth visibility

Australia’s renewable pipeline offers exactly that.

Risks Investors Should Not Ignore

While the strategy looks smart, risks remain:

- Grid congestion and transmission delays

- Policy uncertainty after elections

- Construction cost inflation

- Lower long-term power prices

Private capital partnerships reduce but do not eliminate these challenges.

ltas Opinion Smart Capital, Smarter Survival

ltas Opinion Smart Capital, Smarter Survival

From Altas’ perspective, this shift is not a sign of weakness it’s a sign of maturity.

Australia’s energy giants are realizing that:

“Owning everything is no longer the smartest strategy owning the right share is.”

By inviting private capital into green assets, Origin and AGL are:

- Preserving shareholder value

- Accelerating the energy transition

- Reducing balance-sheet stress

- Staying competitive in a rapidly evolving market

This capital discipline reset may ultimately determine which energy companies thrive and which fall behind.

What This Means for Australia’s Energy Future

If executed well, this model could:

- Speed up renewable deployment

- Stabilize electricity prices

- Reduce taxpayer burden

- Strengthen energy security

Australia’s clean energy future may be built not just on wind and sun but on financial innovation.

FAQ’s

1. Why don’t energy companies just borrow more money for renewables?

Because higher interest rates and volatile power markets make excessive debt risky, especially for long-life assets with regulated returns.

2. Does private capital involvement mean higher electricity prices?

Not necessarily. In many cases, private investors accept lower but stable returns, which can actually reduce long-term cost pressure.

3. Could renewables funds reduce shareholder dividends?

In the short term, possibly. But over time, they often protect dividends by stabilizing cash flow and reducing risk.

4. Is this model reversible if market conditions change?

Yes. Asset-level partnerships allow flexibility companies can buy back stakes or restructure if economics improve.

5. Will coal exits accelerate because of private capital?

Likely yes. Private capital prefers clean assets, indirectly pushing utilities to retire fossil fuel generation faster.

6. Are smaller ASX energy companies likely to follow this model?

Yes. Expect mid-cap energy firms to copy this structure as funding pressure increases.

7. Does this signal the end of utility-owned mega projects?

Not the end but the end of going it alone.

Table of Contents

- Global Markets on Edge- Tech Selloff, Fed Fears, and Iran Tensions Shake Investors-“But Opportunities Are Emerging. (Feb 2026)

- Milano Cortina 2026 Opens With Stunning and With Historic Opening Ceremony- But Critics Question Costs, Climate Impact or as the World Faces Division

- IRS Tax Refund 2026- Bigger Payments Coming for Some, but Delays Loom as Staffing Crisis Deepens

- Marvel’s Wolverine Has Massive Hype – But! Can Insomniac Really Deliver Its Darkest Game Yet? (Feb 2026)

- Fallout Countdown Falls Flat – “This Wasn’t What We Expected’ Fallout Countdown Backlash Erupts Online (Feb 2026)

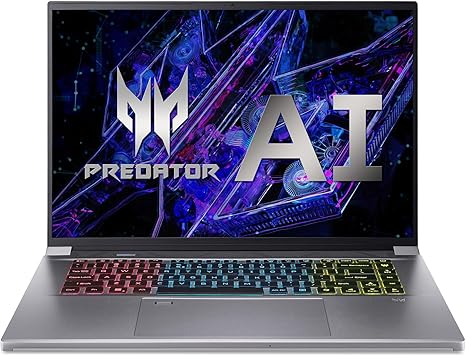

Acer Predator Triton Neo 16 Gaming Creator Laptop

| Brand | acer |

| Model Name | Acer Predator Triton Neo 16 Gaming Creator Laptop |

| Screen Size | 16 Inches |

| Color | Silver |

| Hard Disk Size | 1 TB |

| CPU Model | Intel Core i9 |

| Ram Memory Installed Size | 32 GB |

| Operating System | Windows 11 Home |

| Special Feature | Backlit Keyboard, Fingerprint Reader, Memory Card Slot |

| Graphics Card Description |

Leave a Reply