CARVANA STOCK CRASHES Record Sales Can’t Save Profit Miss as Costs Surge

Introduction

Shares of Carvana dropped sharply after the online used-car retailer reported higher revenue and record vehicle sales yet failed to impress investors on a crucial profit metric. While headline numbers suggested strength, rising operating costs and a cautious outlook overshadowed the company’s apparent progress.

The reaction underscores a hard truth in today’s market growth alone isn’t enough. Investors want profitability, predictability, and disciplined cost control. Carvana delivered the first but stumbled on the latter two.

A Company That Redefined Used Car Buying

Founded in 2012 by Ernest Garcia III, Carvana disrupted the traditional dealership model by offering a fully online car-buying experience. Customers could browse inventory, secure financing, and even receive vehicles via the company’s signature car vending machines.

The company went public in 2017 and rapidly expanded during the pandemic. With consumers stuck at home and stimulus checks flowing, demand for used vehicles surged. Carvana’s stock soared, reaching euphoric highs.

But the momentum didn’t last.

By 2022, rising interest rates, supply chain normalization, and ballooning debt triggered a steep decline. Shares collapsed as investors questioned the company’s sustainability.

In 2023 and 2024, Carvana engineered a remarkable turnaround restructuring debt, cutting costs, and focusing on profitability rather than reckless expansion. The market rewarded those efforts.

Record Sales But At What Cost?

Carvana’s latest earnings report showed

- Record vehicle sales volume

- Higher total revenue

- Improved gross profit per unit (GPU)

On the surface, these metrics painted a bullish picture.

However, the disappointment came from adjusted profit metrics missing expectations. Investors focused heavily on EBITDA margins and forward guidance both of which appeared less robust than hoped.

What hurt the numbers?

- Higher reconditioning and logistics costs

- Rising interest expenses tied to prior debt

- Increased customer acquisition and marketing spend

- Margin compression due to competitive pricing pressures

Wall Street had priced in perfection. Instead, it got progress but not dominance.

Why the Market Reacted So Sharply

Carvana’s stock is highly sensitive to earnings surprises. After its dramatic recovery from near-collapse levels, expectations were elevated.

The issue wasn’t that Carvana lost money it posted higher profit year-over-year. The issue was that the profit didn’t scale as quickly as sales.

In today’s macro environment, investors are wary of

- Companies reliant on consumer credit

- Businesses sensitive to interest rate shifts

- Firms with aggressive expansion histories

Even a slight stumble can trigger a strong selloff.

The Used Car Market Backdrop

The broader used car market remains volatile

- Interest rates remain elevated

- Financing costs are higher

- Vehicle supply is gradually normalizing

- Consumer affordability concerns persist

Carvana operates at the intersection of consumer credit and automotive demand both cyclical industries.

If rates stay higher for longer, financing could dampen momentum.

Balance Sheet Stronger, But Not Bulletproof

One bright spot Carvana’s debt restructuring significantly improved liquidity. The company avoided a worst-case bankruptcy scenario and extended maturities.

However, interest expenses remain material. Higher sales don’t automatically translate into higher net margins when debt servicing is involved.

Investors are now asking

Can Carvana grow and expand margins consistently?

Competitive Landscape

Carvana faces competition from

- Traditional dealerships adopting digital tools

- Hybrid online models

- Peer used car platforms

- Direct-to-consumer listings

The ease of online car shopping is no longer unique.

The company must now compete on efficiency, inventory management, and pricing power.

ltas Opinion

ltas Opinion

Carvana’s story is no longer about survival it’s about sustainability.

The turnaround has been impressive. Few expected Carvana to rebound this strongly after its near-collapse.

But markets are forward-looking.

The recent drop signals that investors want more than improvement they want dominance and predictable margins.

If Carvana can prove that record sales translate into durable profit expansion, the stock could regain momentum. If costs continue creeping upward, volatility will remain the norm.

This is no longer a hype stock. It’s a performance stock.

And performance must improve quarter after quarter.

What Investors Should Watch Next

- Gross Profit Per Unit trends

- EBITDA margin expansion

- Debt reduction progress

- Used car pricing stability

- Management’s forward guidance clarity

The next earnings cycle could determine whether this dip becomes a buying opportunity or the start of another downward spiral.

FAQs

Why did Carvana stock fall if sales were strong?

Because profit metrics and outlook guidance failed to meet investor expectations.

Is Carvana profitable?

The company has improved significantly, but margin sustainability remains under scrutiny.

Does interest rate policy impact Carvana?

Yes. Higher rates increase financing costs for both the company and customers.

Is Carvana’s turnaround over?

Not necessarily. The turnaround phase may be complete but now comes the harder phase sustained profitability.

Is this dip a buying opportunity?

That depends on whether margins stabilize and guidance strengthens in upcoming quarters.

- Carvana Stock Plunges Despite Record Sales, What Went Wrong?

- STOXX 600 Climbs to All-Time High- Hits Record High on Earnings Surge – But Inflation and ECB Risks Cloud the Outlook

- Global Markets on Edge- Tech Selloff, Fed Fears, and Iran Tensions Shake Investors-“But Opportunities Are Emerging. (Feb 2026)

- Milano Cortina 2026 Opens With Stunning and With Historic Opening Ceremony- But Critics Question Costs, Climate Impact or as the World Faces Division

- IRS Tax Refund 2026- Bigger Payments Coming for Some, but Delays Loom as Staffing Crisis Deepens

Table of Contents

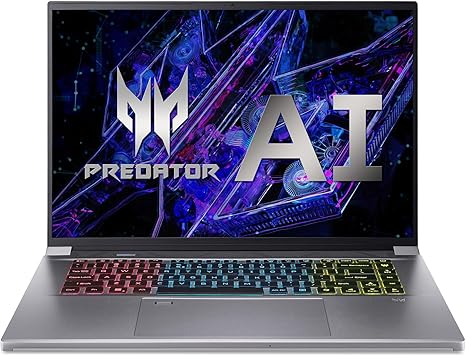

Acer Predator Triton Neo 16 Gaming Creator Laptop

| Brand | acer |

| Model Name | Acer Predator Triton Neo 16 Gaming Creator Laptop |

| Screen Size | 16 Inches |

| Color | Silver |

| Hard Disk Size | 1 TB |

| CPU Model | Intel Core i9 |

| Ram Memory Installed Size | 32 GB |

| Operating System | Windows 11 Home |

| Special Feature | Backlit Keyboard, Fingerprint Reader, Memory Card Slot |

| Graphics Card Description |

Leave a Reply