China Slaps 55% Tariffs on Imported Beef, A Strategic Trade Shock With Global Consequences

Introduction: A Major Trade Move as 2025 Closes

As 2025 approaches its final weeks, China has escalated trade tensions by announcing additional tariffs of up to 55% on certain imported beef products, primarily targeting Brazil, Australia, and the United States. The decision follows a year-long investigation into imported meat pricing and market impact, signaling that Beijing is once again willing to use trade policy as a geopolitical and economic lever.

The move arrives during the Christmas holiday season, a period when global food supply chains are already strained by logistics slowdowns, rising insurance costs due to geopolitical risks, and fragile consumer demand. While French beef exports to China have recently resumed, they remain marginal and are unlikely to offset the broader disruption.

This article breaks down what happened, why it matters, who wins and loses, and what comes next with deep insights, forecasts, and expert analysis.

What Exactly Did China Announce?

Key Details of the Tariff Decision

- Additional tariffs of up to 55% imposed on selected beef imports

- Targeted countries:

- 🇧🇷 Brazil

- 🇦🇺 Australia

- 🇺🇸 United States

- Decision follows a 12-month trade and anti-dumping investigation

- Official justification:

- “Protecting domestic producers”

- “Preventing unfair pricing practices”

- Enforcement begins immediately, with customs authorities instructed to apply revised rates at ports

Chinese authorities stated that certain exporters were selling beef below fair market value, allegedly harming domestic cattle farmers and processors.

Why China Is Doing This Now

1. Domestic Economic Pressures

China’s economy in late 2025 faces:

- Weak consumer confidence

- Slowing retail demand

- Struggles in rural agricultural income

Beef imports surged earlier in the year due to lower global prices, putting pressure on local Chinese cattle farmers, particularly in Inner Mongolia and western provinces.

Raising tariffs is a fast political fix to stabilize domestic prices.

2. Strategic Geopolitical Signaling

This decision is not happening in isolation.

- 🇺🇸 US–China tensions remain high over technology, Taiwan, and trade controls

- 🇦🇺 Relations with Australia remain fragile despite diplomatic thawing

- 🇧🇷 Brazil, while politically closer to China, dominates beef exports and holds pricing power

By targeting three major suppliers at once, Beijing sends a clear message:

China will not hesitate to weaponize market access.

3. Food Security and Self-Reliance Agenda

China continues to push its food security strategy, aiming to:

- Reduce dependence on foreign protein

- Strengthen domestic livestock production

- Diversify import sources

Beef, once considered a luxury protein in China, has become mainstream making control over pricing politically sensitive.

Impact on Exporting Countries

🇧🇷 Brazil: The Biggest Loser

- Brazil is China’s largest beef supplier

- Tariffs could:

- Slash export volumes

- Force Brazilian exporters to seek alternative markets (Middle East, Southeast Asia)

- Pressure domestic cattle prices

Brazilian meat processors are already warning of margin compression and layoffs.

🇦🇺 Australia A Familiar Shock

Australia has faced Chinese trade restrictions before, including:

- Wine

- Barley

- Coal

The beef sector now joins that list again. Analysts warn:

- Smaller exporters may exit the China market entirely

- Long-term trust damage may linger despite political dialogue

U.S “United States Trade Tensions Reignite

US beef exports to China had already been volatile due to:

- Regulatory barriers

- Currency fluctuations

- Political friction

The new tariffs effectively price US beef out of the Chinese market, strengthening arguments in Washington that trade decoupling is accelerating.

What About France and Europe?

French Beef Back, But Still Small

France recently resumed limited beef exports to China after lengthy sanitary negotiations. However:

- Volumes are minimal

- Production costs are high

- Logistics remain expensive

Europe may benefit symbolically, but not economically at least in the short term.

Impact on Chinese Consumers

Will Beef Prices Rise in China?

Short-term outlook:

- ✅ Prices likely to rise modestly

- ❌ Selection may narrow, especially for premium cuts

However, China may:

- Increase imports from secondary suppliers (Argentina, Uruguay)

- Promote pork and poultry as substitutes

The government is expected to manage inflation carefully, especially during holiday consumption periods.

Christmas Season Timing: Why It Matters

Announcing the tariffs during late December is strategic:

- Global markets are thin

- Exporters have limited time to respond

- Political backlash is muted during holidays

For importers and traders, this timing increases:

- Contract uncertainty

- Shipping delays

- Legal disputes over pricing terms

Market and Commodity Forecast

Global Beef Market Outlook (2026)

- 🌍 Global beef prices likely to become more volatile

- 📉 Oversupply risk in Brazil and Australia

- 📈 Price support for Chinese domestic producers

- 🔄 Trade flows re-routing to Middle East, ASEAN, and Africa

Inflation Impact

- Minimal global inflation impact

- Localized food inflation risk in China

- Potential deflationary pressure in exporting nations

ltas Opinion Strategic Protection or Risky Overreach?

ltas Opinion Strategic Protection or Risky Overreach?

Altas Viewpoint:

China’s 55% beef tariffs are less about meat and more about leverage.

While the move supports domestic farmers in the short term, it carries risks:

- Encourages exporters to diversify away from China

- Reinforces perceptions of China as an unpredictable trade partner

- Accelerates global supply-chain fragmentation

Long term, food security through isolation rarely works. Sustainable resilience comes from balanced trade, not blunt tariffs.

What to Watch Next

- Possible retaliatory measures from affected countries

- WTO complaints or trade arbitration

- China expanding tariffs to other agricultural products

- New trade deals between exporters and alternative markets

FAQs

❓ Why 55% tariffs specifically?

The rate reflects a combination of existing duties plus newly imposed anti-dumping penalties.

❓ Are all beef imports affected?

No. Only specific products and exporters identified in the investigation.

❓ Will China reverse the tariffs?

Possible, but only if:

- Market conditions stabilize

- Political concessions occur

- Domestic production improves

❓ Does this affect global food security?

Indirectly. It increases regional supply imbalances, but does not threaten global shortages.

❓ Who benefits the most?

- Chinese domestic cattle farmers

- Secondary beef-exporting nations not targeted

Final Thoughts

China’s decision to impose 55% tariffs on imported beef marks another chapter in the evolving global trade landscape where economics, politics, and food security collide.

As 2026 approaches, this move will reshape meat trade flows, test diplomatic relationships, and remind exporters of a hard truth:

Access to the Chinese market is powerful but never guaranteed.

Table of Contents

- NASA’s Artemis II Reaches the Launch Pad- A Historic Return to the Moon-With High Stakes and Unanswered Risks (January 2026)

- TFSA- “War, Inflation, and Market Volatility Rise-Yet TFSAs Remain One of Canada’s Safest Wealth Tools” (January 2026)

- UN at 80- UK Steps Forward to Support UN80 Reforms as Guterres Calls for Global Reset (January 2026)

- Canada EV Market Fell Off a Cliff-Now Chinese EVs and a Trump Endorsement Change the Game! (January 2026)

- The Rip a “Netflix’s Series, A Gritty Damon–Affleck Reunion That Could Redefine Streaming – Or Fade as Familiar Crime Fare” (January 2026)

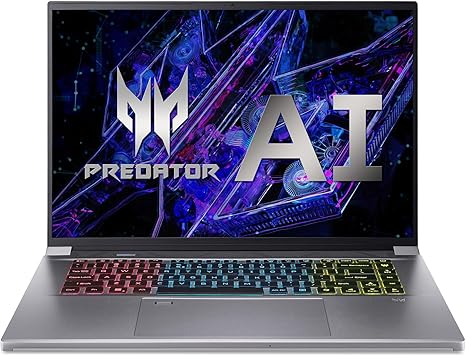

Acer Predator Triton Neo 16 Gaming Creator Laptop

| Brand | acer |

| Model Name | Acer Predator Triton Neo 16 Gaming Creator Laptop |

| Screen Size | 16 Inches |

| Color | Silver |

| Hard Disk Size | 1 TB |

| CPU Model | Intel Core i9 |

| Ram Memory Installed Size | 32 GB |

| Operating System | Windows 11 Home |

| Special Feature | Backlit Keyboard, Fingerprint Reader, Memory Card Slot |

| Graphics Card Description |

Leave a Reply