Weekly Market Outlook, Crypto Demand Stays Weak as Gold Eyes $4,300 Breakout and EUR/USD Faces Key Tests

Introduction Markets Enter a Critical Year-End Phase

As the final weeks of the year approach, global financial markets are entering a highly sensitive transition period. Cryptocurrency markets remain under pressure due to weak demand, while precious metals are gaining strength amid inflation uncertainty and geopolitical risks. At the same time, EUR/USD traders are preparing for a decisive week, driven by macroeconomic data, central bank signals, and shifting risk sentiment.

With liquidity thinning and volatility risks rising, the coming week could set the tone for how markets close the year and potentially how 2026 begins.

Weekly Crypto Outlook Demand Remains Weak Despite Short-Term Stability

Market Structure & Sentiment

The cryptocurrency market continues to show persistent bearish pressure, even as major assets attempt short-term rebounds. Bitcoin and Ethereum have stabilized within tight ranges, but spot demand remains notably weak.

Key factors weighing on crypto:

- Reduced retail participation

- Institutional caution near year-end

- Regulatory uncertainty in key regions, including Europe

- Competition from high-yield bonds and cash instruments

Stablecoins like USDT and USDC are seeing steady inflows not as bullish signals, but as capital parked on the sidelines.

Weekly Crypto Forecast

- Bitcoin (BTC): Likely to remain range-bound with downside risk if macro sentiment deteriorates.

- Altcoins: Vulnerable to sharp pullbacks due to thin liquidity.

- Overall Bias: Bearish to neutral unless a strong macro catalyst emerges.

Gold Price Forecast $4,300 Test Looms as CPI Shock Fuels Bets

Current Market Dynamics

Gold (XAU/USD) has entered a low-volatility consolidation phase, forming a tight range after a strong rally. This behavior often precedes a large directional move.

Drivers supporting gold:

- Softer inflation readings

- Expectations of future Fed rate cuts

- Ongoing geopolitical tensions

- Strong central bank buying

Technically, gold is forming a symmetrical triangle pattern, signaling that pressure is building.

Weekly Gold Outlook

- Key Resistance: $4,300

- Breakout Scenario: A clean move above $4,300 could open the door toward new record highs.

- Pullback Scenario: Any dip is likely to attract buyers as long as prices hold above major support zones.

Bias: Bullish, with breakout risk increasing into year-end.

Silver Price Forecast Momentum Holds After Inflation Dip

Silver continues to outperform on a relative basis, benefiting from:

- Gold’s bullish structure

- Industrial demand expectations

- Inflation-linked hedging behavior

Silver remains more volatile than gold but retains strong upside momentum as long as macro conditions favor metals.

Weekly Bias: Bullish, with higher volatility than gold.

EUR/USD Weekly Forecast Momentum Faces a Test

The euro has held firm but is starting to lose momentum near key resistance levels. Traders are closely watching:

- Inflation data

- ECB communication

- Broader US dollar strength tied to Fed policy expectations

EUR/USD Outlook

- Upside Risk: If the dollar weakens further, EUR/USD could attempt another push higher.

- Downside Risk: Strong US data or hawkish Fed commentary could trigger a pullback.

Bias: Neutral to cautiously bullish, but volatility risk is elevated.

War & Geopolitical Risks The Silent Market Driver

Geopolitical tensions remain a background force influencing capital flows:

- Ongoing conflicts are supporting safe-haven assets like gold

- Energy and supply-chain concerns continue to affect inflation expectations

- Risk assets remain vulnerable to sudden sentiment shifts

Markets are currently pricing geopolitical risk quietly, but sudden escalation could trigger rapid moves.

Relief Measures vs. Market Reality, A Turning Point for Global Assets

President Trump’s push to slash prescription drug prices and introduce the $1,776 Warrior Dividend has created an immediate sense of economic relief, particularly among U.S. consumers facing high healthcare and living costs. By lowering drug prices, inflation pressure on household budgets may ease, while direct payments inject liquidity into the economy often a short-term positive for consumer confidence and spending.

Yet financial markets rarely respond to relief in a straight line. As investors digest the scale and funding of these initiatives, questions around fiscal sustainability, inflation risks, and long-term policy direction are beginning to surface raising the potential for volatility across multiple asset classes.

Crypto Markets Short-Term Fuel, Long-Term Questions

Cryptocurrencies often benefit from increased liquidity, and stimulus-style measures can temporarily boost speculative demand. Bitcoin, Ethereum, and high-beta altcoins may see short-term inflows as retail investors deploy extra cash. At the same time, stablecoins like USDT and USDC could experience rising demand as traders prepare for sharp price swings.

However, if markets perceive Trump’s policies as inflationary or politically contentious, risk appetite could quickly reverse. Crypto remains highly sensitive to macroeconomic uncertainty, meaning relief-driven rallies may be fragile and short-lived without sustained demand.

Forex & Dollar Outlook Strength or Stress?

In foreign exchange markets, the US dollar may initially benefit from improved consumer sentiment and expectations of economic resilience. But longer-term risks loom. Expanding fiscal programs can widen deficits and complicate the Federal Reserve’s inflation fight potentially weakening the dollar against safe-haven currencies like the Japanese yen or Swiss franc.

Currency traders are closely watching signals from the Fed, particularly whether Powell’s tone shifts in response to these policies. Any hint of policy conflict could rapidly increase volatility across major currency pairs.

Broader Markets Calm Before a Shake-Up?

Equities, especially in healthcare and consumer sectors, may welcome lower drug prices and stronger spending power. Yet investors remain cautious. If inflation expectations rise or geopolitical tensions intensify, markets could quickly shift into a risk-off mode, favoring gold and defensive assets over growth plays.

🔍 Altas Perspective

Relief measures often stabilize sentiment but they don’t eliminate uncertainty. Trump’s economic initiatives may support markets in the short term, yet they also introduce policy and inflation risks that can amplify volatility. For traders and investors, this environment calls for flexibility, risk management, and readiness for sudden market swings rather than complacency.

ltas Opinion The Calm Before a Larger Move

ltas Opinion The Calm Before a Larger Move

From an Altas perspective, markets are currently in a compression phase

- Crypto markets reflect exhaustion and lack of conviction

- Gold and Silver are coiling for a potential breakout

- EUR/USD is awaiting a catalyst

- Liquidity conditions suggest that any surprise could produce outsized moves

This environment favors disciplined risk management, patience, and strategic positioning rather than aggressive speculation.

Altas Insight: Low volatility does not mean low risk. Historically, periods like this often precede sharp, fast-moving trends.

Weekly Summary Table (Quick View)

| Asset | Weekly Bias | Key Theme |

|---|---|---|

| Crypto | Bearish–Neutral | Weak demand, low conviction |

| Gold (XAU/USD) | Bullish | Breakout risk above $4,300 |

| Silver | Bullish | Momentum + inflation hedge |

| EUR/USD | Neutral–Bullish | Data-dependent |

| Risk Sentiment | Fragile | Geopolitics + macro |

FAQ’s

Q1: Why is crypto demand still weak despite stable prices?

Because most recent price stability is driven by derivatives and not strong spot buying. Real demand remains cautious.

Q2: Is gold likely to break above $4,300 next week?

Yes, if CPI data or geopolitical developments support lower real yields and risk aversion.

Q3: Why is silver moving faster than gold?

Silver benefits from both precious metal demand and industrial usage, making it more sensitive to macro shifts.

Q4: Can EUR/USD sustain gains into year-end?

Only if US data weakens and the Fed maintains a dovish tone. Otherwise, consolidation or pullbacks are possible.

Q5: What is the biggest risk to markets next week?

Unexpected inflation data or geopolitical escalation during low-liquidity conditions.

Final Thoughts

As markets head deeper into year-end territory, patience and preparedness will define success. Crypto remains fragile, gold and silver are building pressure, and forex markets are balancing on a knife-edge of macro uncertainty.

The coming week may not just determine short-term direction but could shape how global markets enter 2026.

Table of Contents

- Global Markets on Edge- Tech Selloff, Fed Fears, and Iran Tensions Shake Investors-“But Opportunities Are Emerging. (Feb 2026)

- Milano Cortina 2026 Opens With Stunning and With Historic Opening Ceremony- But Critics Question Costs, Climate Impact or as the World Faces Division

- IRS Tax Refund 2026- Bigger Payments Coming for Some, but Delays Loom as Staffing Crisis Deepens

- Marvel’s Wolverine Has Massive Hype – But! Can Insomniac Really Deliver Its Darkest Game Yet? (Feb 2026)

- Fallout Countdown Falls Flat – “This Wasn’t What We Expected’ Fallout Countdown Backlash Erupts Online (Feb 2026)

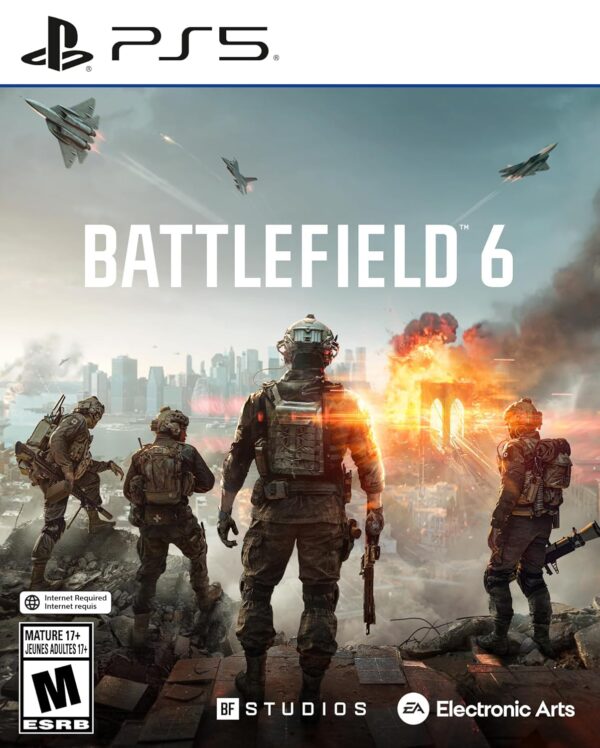

Battlefield 6 – Sony PlayStation 5

Product information

| UPC | 014633382143 |

|---|---|

| ASIN | B0FJHS8TH5 |

| Release date | October 10, 2025 |

| Customer Reviews |

4.5 out of 5 stars |

| Best Sellers Rank |

|

| Product Dimensions | 0.57 x 6.98 x 5.26 inches; 2.88 ounces |

| Type of item | Video Game |

| Language | English |

| Rated | Mature |

| Item model number | 38214 |

| Item Weight | 2.88 ounces |

| Manufacturer | Electronic Arts |

| Date First Available | July 31, 2025 |

Leave a Reply