Cameroons 2026 Budget Between Big Infrastructure Ambitions and Massive Fiscal Pressure

Budget Size, Deficit and Borrowing Plan

- The draft 2026 budget for Cameroon is set at CFA 8,816.4 billion (roughly $14.7 billion), a 14% increase over the 2025 budget. Ecofin Agency+2businessincameroon.com+2

- Of this, the general budget is about CFA 8,683.9 billion, while “Special Appropriation Accounts” (special funds) are projected at CFA 132.5 billion nearly double last year’s figure, driven in part by a new fund for women’s economic empowerment and youth employment. Ecofin Agency+1

- To fund this expansion, the government plans to borrow CFA 3,104.2 billion in 2026 through external loans, project-loan disbursements, bank financing, public securities, and other financing mechanisms. Ecofin Agency+2Ecofin Agency+2

- As a result, the budget deficit is projected to rise to CFA 631 billion more than double the previous year’s deficit (CFA 309.9 billion). Investing.com+2MarketScreener UK+2

- Overall financing needs (including debt servicing and other charges) will reach CFA 3,104.2 billion. MarketScreener+1

Bottom line Cameroon is going for a major spending push in 2026 but at the cost of sharply increased borrowing and a large fiscal deficit.

Infrastructure & Public Works The Heart of 2026 Spending

The 2026 budget emphasizes infrastructure particularly roads and connectivity as its flagship priority. Ecofin Agency+2africasupplychainmag.com+2

What is Planned

- The Ministry of Public Works plans to devote 92% of its 2026 public-works budget to constructing, rehabilitating, and maintaining the national road network. Ecofin Agency+1

- Specifically: 650 kilometers of new paved roads, over 1,300 meters of structures (bridges/overpasses), plus maintenance programs for existing roads. Ecofin Agency+1

- At the local level, budget for communal-road maintenance is being raised by 38.5%, from 11.6 billion XAF to 16.1 billion XAF in 2026 aiming to improve the 81% of national roads that are unpaved or in poor condition. businessincameroon.com+1

- The increased road funding also targets rural and urban-peripheral connectivity, signaling a push to reduce regional disparities in access. africasupplychainmag.com+1

Why This Matters

- Better roads could significantly improve domestic trade logistics, market connectivity, and ease of travel, especially in rural areas long cut off by poor infrastructure.

- For businesses, it can lower transportation costs; for citizens, it improves access to services, mobility, and opportunities.

- Over medium-term (2026–2029), construction industry analysts project growth at ~6.3% annually, driven by public-private investment under the national infrastructure push. GlobeNewswire

Cameroon may be betting that infrastructure investment now yields long-term economic gains but success depends heavily on efficient execution, oversight, and debt management.

Debt Risk & Fiscal Pressure A Dangerous Tightrope

The aggressive expansion comes with significant risks. Key concerns

High Debt Burden & Risk of Distress

- To finance 2026’s commitments, the government intends to borrow deeply: external borrowing, domestic loans, securities, project loans increasing its debt exposure. Ecofin Agency+2businessincameroon.com+2

- Debt servicing costs are rising, limiting fiscal space for future social spending or public services. Cameroon’s existing debt already absorbs a large share of revenue. camepi.org+1

- According to regional monitors (e.g. the IMF and AfDB), Cameroon remains a “high-risk” country for debt distress, especially in the face of external shocks. Ecofin Agency+2cameroonintelligencereport.com+2

Vulnerability to External Shocks

- Cameroon relies heavily on imports (fuel, wheat, vehicles). Price volatility globally (e.g. fuel) may force more government spending and erode revenue. Investing.com+1

- Declining oil output or global commodity price swings (impacting timber, oil, cocoa) can cut export revenue, affecting debt-servicing capacity. Investing.com+2World Bank+2

Trade-Off Infrastructure vs. Social Services

- With large portions of the budget tied to roads and capital projects, funding for health, education, and welfare may be squeezed unless revenue increases or debt is managed carefully. camepi.org+2bankofscotlandtrade.co.uk+2

- If economic gains from infrastructure take time to materialize, the population may experience delayed benefits, while debt burdens accumulate now.

Economic Outlook: Growth Hopes But Not Guaranteed

According to the draft budget bill:

- GDP growth is forecast at 4.3% in 2026, slightly up from 3.9% in 2025. The growth driver is expected to be the non-oil sector (construction, agriculture, services). Investing.com+2cameroonconcordnews.com+2

- Inflation is projected to moderate slightly, easing to around 3.0% by 2026, improving macroeconomic stability if achieved. Investing.com+1

- Construction and infrastructure investments especially roads are expected to stimulate related industries (cement, logistics, services), creating employment and structural growth over medium term. GlobeNewswire+2africasupplychainmag.com+2

But these projections depend heavily on stable global commodity prices, favorable external financing conditions, and effective public-investment execution. Any major shock in oil price, foreign exchange, or debt markets could derail expectations.

ltas Opinion Ambitious Strategy, High-Stakes Gamble

ltas Opinion Ambitious Strategy, High-Stakes Gamble

From Altas’ vantage point, Cameroon’s 2026 budget represents a bold even inevitable push toward modernization. The timing aligns with rising public demand, a young population needing opportunity, and growing recognition that transport and infrastructure deficits hold back long-term growth.

The Upside

- If road projects and infrastructure plans are delivered on time and transparently, Cameroon could unlock years of productivity gains. Rural connectivity, easier trade routes, better transport could reduce poverty and regional inequality.

- Diversifying the economy away from oil reliance by boosting construction, agriculture, services could insulate the country against commodity shocks.

- By investing in projects now, Cameroon might build momentum: private investment, job creation, foreign interest, and improved living standards.

The Risk

- The scale of borrowing and debt servicing makes the country vulnerable to external pressure especially interest-rate rises, currency devaluation, global price shocks.

- Infrastructure projects often suffer from cost overruns, mismanagement, and delay meaning promised benefits could take years or even decades to materialize, if at all.

- If revenue targets are missed due to weak exports or tax collection shortfalls the debt burden could spiral, forcing austerity or cuts to social services.

Conclusion: Cameroon’s 2026 budget is a “do or die” bet. If managed wisely, it could usher in a new era of growth and development. If mismanaged or hit by global headwinds it risks becoming a debt trap with little to show in terms of real benefits.

Watchpoints for 2026–2027

| Indicator | What to Watch | Why It Matters |

|---|---|---|

| Debt-to-GDP ratio | Stay below CEMAC’s 70% threshold | Keeps debt from becoming unsustainable |

| Debt servicing vs Revenue growth | Servicing < 20–25% of revenue | To avoid crowding out essential spending |

| Completion rate of road & infrastructure projects | > 80% on time/completion | Determines whether physical benefits materialize |

| Exports / Forex resilience | Stability in export prices & forex reserves | Protects against external shocks |

| Social spending levels (health, education, welfare) | Maintained or increased | Prevents inequality and social discontent |

FAQs

1. Why is Cameroon accelerating infrastructure spending specifically in 2026 instead of spreading it gradually?

The government anticipates that delaying infrastructure investments further would increase future costs due to rising construction prices, population growth, and inflation. 2026 is seen as the last window to execute major projects before debt-service pressure becomes too high.

2. Will the large road-construction budget actually translate to lower food prices for citizens?

Potentially yes but only if logistics improvements reach rural food-producing areas. Cameroon’s food inflation is heavily influenced by transport costs; improved roads can lower prices, but benefits will vary regionally depending on project completion speed.

3. Is the government expecting private investors to join these infrastructure projects?

Yes. While not explicitly stated in official releases, internal planning documents encourage PPPs (public-private partnerships) for road tolling, logistics hubs, and energy infrastructure. The borrowing push suggests the government is positioning itself to attract private capital by first upgrading foundational infrastructure.

4. How will Cameroon manage project corruption risks in 2026?

Although road corruption has historically been a challenge, 2026 contracts are expected to use more digital procurement systems and satellite-based project monitoring to reduce fraud. This is a quiet but meaningful shift behind the scenes.

5. Could the growing deficit impact public-sector salaries or subsidies in the next few years?

Yes. If borrowing costs rise or revenue underperforms, the government may freeze hiring, delay salary adjustments, or reduce subsidies. These consequences would likely appear in 2027–2028, not immediately in 2026.

6. What risks could derail the government’s infrastructure plan?

Key threats include:

- Delays in loan disbursement from international partners

- Global fuel price spikes inflating project costs

- Shortage of skilled labor for roadwork

- Heavy rainy seasons damaging partially completed projects

7. Is the 2026 budget designed with upcoming elections in mind?

While not officially stated, the budget’s heavy focus on highly visible projects (roads, bridges, urban connectivity) strongly suggests a political motivation to demonstrate national progress ahead of future political cycles.

8. What long-term financial obligation will this 2026 borrowing create for the average Cameroonian?

The loans being contracted now will mature over 10–25 years, meaning today’s budget decisions will influence tax pressure and public-service resources until 2050 or beyond.

9. How will rural communities be affected differently compared to major cities?

Urban centers will feel benefits sooner (improved traffic, better access to logistics hubs). Rural communities will see long-term improvement but only after major trunk roads are completed, which could take until 2027–2029.

10. What is the biggest unspoken challenge of Cameroon’s 2026 budget?

Execution capacity. Cameroon has historically struggled to complete more than 60–65% of its planned public-investment projects annually. Even with larger funds, the biggest question is not “how much is allocated,” but “how much will truly be delivered.”

Table of Contents

- Resident Evil Requiem Becomes 2026’s Highest-Rated Game – A Survival Horror Masterpiece or an Overhyped Sequel That Loses Steam?

- Black Ops 7 Sets a New Standard for Tactical FPS Combat – But Controversy and Matchmaking Frustrations Spark Debate

- Ghostrunner 2 Free on Epic Games, A Cyberpunk Masterpiece of Relentless Action – or a Brutally Punishing Game That’s Too Hard to Love?

- Code Vein II Is a Beautiful Evolution – But Its Uneven World Holds It Back! Or Does It Still Lack the Crown? (Feb 2026)

- Nioh 3 Review- A Brutal Soulslike Masterpiece That Perfects Samurai Combat – Or an Unforgiving Grind That Pushes Players Too Far?

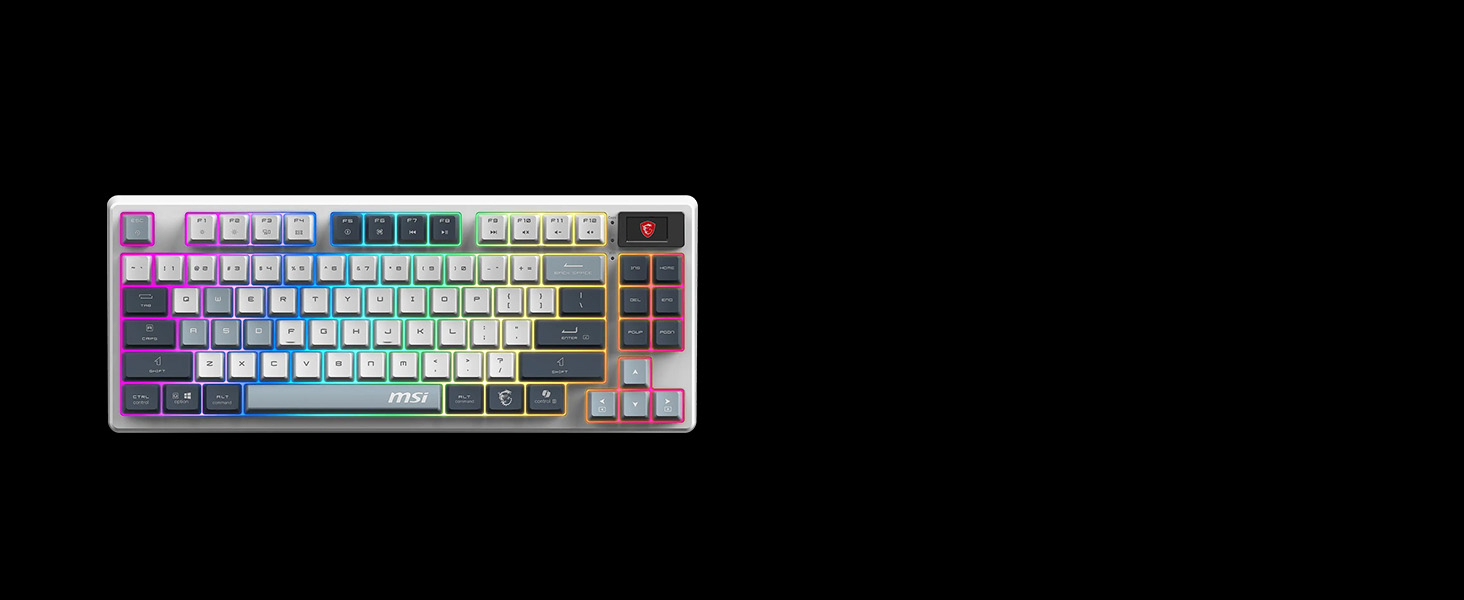

FORGE GK600 TKL WIRELESS SKY

FORGE GK600

About this item

- DURABLE MECHANICAL SWITCHES – The mechanical Linear switches feature a lifespan of 50+ million keystrokes per key that deliver crisp, audible, and linear actuation

- DYE-SUBLIMATED PBT KEYCAPS – The GK600 TKL Wireless Sky employs a tenkeyless-sized keyboard layout with dye-sublimated PBT keycaps for improved durability and comfort

- TRI-MODE CONNECTIVITY – The FORGE GK600 TKL WIRELESS SKY supports both wired (1.8m USB 2.0) & wireless (2.4GHz & Bluetooth) connectivity with a 4000mAh rechargeable battery providing up to 20 days of continuous gameplay (RGB LED turned off)

- INTUITIVE CONTROL & DISPLAY A 1.06-inch screen provides key details such as battery status, RGB lighting profiles, and brightness settings, ensuring quick and easy access to essential information

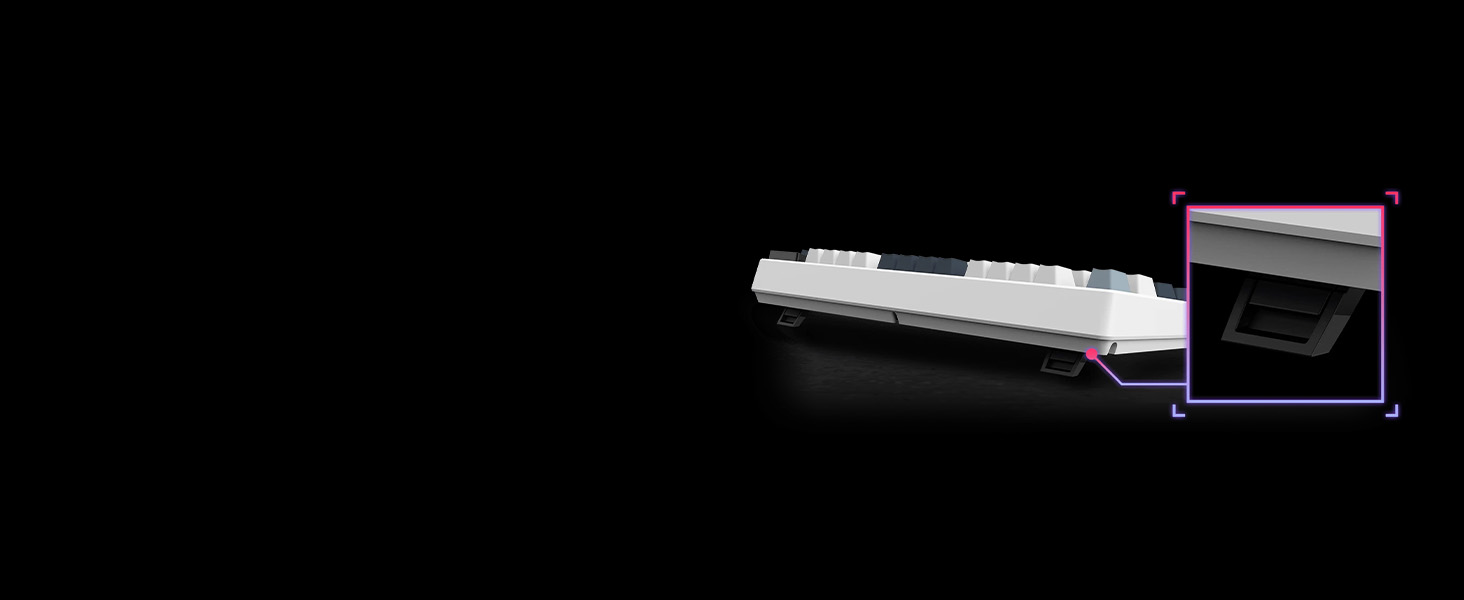

- HOT-SWAPPABLE DESIGN – Easily swap default mechanical switches with 5-pin compatible ones, no soldering required. Customize your typing experience with ease, ensuring flexibility and lasting durability.

Leave a Reply