Loan Shockwave, Trump-Era Reset on Student Loans and the Fall of the SAVE Plan

What Happened SAVE Plan Terminated & Payment Pause Ends

- On December 9, 2025, the U.S. Department of Education announced a settlement with the State of Missouri (and other states) officially ending the SAVE Plan.

- Under the settlement, the Department will:

- Stop enrolling any new borrowers in SAVE.

- Deny all pending SAVE applications.

- Begin transitioning current SAVE borrowers more than 7 million nationwide into legally compliant federal repayment plans.

- Additionally, even before the formal end, the Department had already resumed interest accrual on SAVE loans as of August 1, 2025.

- Loans that had been in forbearance (interest-free, no monthly payments) are now accruing interest and borrowers are being asked to choose new repayment plans or be assigned one.

Bottom line A plan once marketed as low-payment and potentially forgiving is now dismantled borrowers must act fast.

Why the SAVE Plan Was Ended

- Federal courts repeatedly struck down key provisions of the SAVE Plan (especially around zero-interest deals and fast forgiveness), concluding that the administration lacked congressional authorization to alter loan repayment and forgiveness rules so radically.

- The Department of Education, under the Trump administration, criticized SAVE as an unlawful “loan forgiveness scheme,” saying it placed the burden on taxpayers, many of whom never took out student loans.

- The settlement aims to restore what officials call “fiscal responsibility” and return to legally compliant repayment frameworks.

What It Means for Borrowers Payments, Interest, and Financial Consequences

Short-Term Impacts

- Borrowers currently in SAVE must pick a new repayment plan soon. If they don’t, they may be defaulted onto a standard or income-based plan as determined by loan servicers.

- Since interest began accruing in August 2025, loan balances are growing even before new payments begin meaning many borrowers will pay more overall than they planned.

- Monthly payments under older plans (like Income-Based Repayment (IBR), Income-Contingent Repayment (ICR) or Pay As You Earn (PAYE)) are often higher than what many SAVE borrowers were paying — or not paying at all.

Long-Term Risks

- Borrowers who relied on SAVE’s generous interest-subsidy and forgiveness promises may see significantly higher lifetime repayment costs.

- For many low-income borrowers, the change may derail financial plans buying a home, saving money, getting married because of higher monthly obligations and growing debt.

- There’s a risk of increased defaults, especially among borrowers unprepared for higher payments which can damage credit scores and long-term financial stability.

What Are the Alternative Repayment Plans Now?

With SAVE gone, borrowers must choose among legally valid plans

| Repayment Plan | Key Features | Trade-offs |

|---|---|---|

| IBR (Income-Based Repayment) | Payments based on income and family size; forgiveness after 20–25 years if eligible | Monthly payments often higher than SAVE longer total repayment time |

| ICR (Income-Contingent Repayment) | Payment based on income or standard plan (whichever is lower) | Less generous interest subsidy higher interest accumulation |

| PAYE (Pay As You Earn) | Lower monthly payments for eligible borrowers; partial forgiveness after long-term | Limited eligibility payments may still be burdensome |

| Standard Repayment | Fixed payments over 10 years | Highest monthly payment; no forgiveness after 10 years |

Some future options may include a new Repayment Assistance Plan (RAP) slated for launch by mid-2026 but details remain uncertain, and early indications suggest it may also carry less favorable terms than SAVE.

What borrowers should do now Use the loan-simulator tools on StudentAid.gov assess income, projected payments, and long-term cost under different plans and, if eligible, apply for IBR or ICR promptly to avoid being straddled with standard plans.

Broader Implications For Borrowers, Higher Education, and the Economy

- The end of SAVE may push more borrowers into financial hardship, especially young professionals and low-income workers potentially affecting housing, spending, and long-term financial stability.

- Student debt, already a hot-button economic issue, may worsen: increased defaults, less disposable income, and less financial mobility for a generation.

- For education policy this move signals that student loan relief via executive action is fragile future borrowers may hesitate to take student loans, fearing that relief programs can be reversed depending on political changes.

- It may also increase pressure on Congress to enact long-term structural reform in higher education financing or risk a rise in personal bankruptcies, defaults, and financial instability among graduates.

ltas Opinion What’s the Real Cost Behind This “Reset”?

ltas Opinion What’s the Real Cost Behind This “Reset”?

1. Borrowers Get Hit the Hardest

Altas believes this policy shift strikes hardest at those who relied on relief: young graduates still building careers, low-income borrowers, public-service workers. For many, this is less a “reset” and more a “blow” forcing immediate payments, growing debt, and uncertainty.

2. Lost Trust & Broken Promises

SAVE was launched with a promise: manageable payments, possible forgiveness, a fresh start. Now, in the span of a few legal decisions and a new administration, those promises are gone. This erodes borrower confidence and may discourage future generations from using federal loans.

3. Short-Sighted Cost-Cutting Over Human Impact

The justification fiscal responsibility, taxpayer protection may make sense on paper. But it overlooks the human cost: financial stress, lost opportunity, lowered quality of life, fewer chances for upward mobility. Altas sees this as a case where budget-balancing trumps social equity.

4. A Wake-Up Call for Systemic Reform

Rather than chopping off relief programs whenever politically convenient, what we need is a long-term rethinking affordability in higher education, transparent loan terms, sustainable repayment plans, and protections for low-income graduates. Dismantling SAVE without a humane substitute that’s a missed opportunity.

FAQs

Q1: Could borrowers retroactively receive credit toward forgiveness for years already paid under SAVE before cancellation?

A: Likely not. Since SAVE is declared unlawful, any progress made under its terms (interest subsidies, payment credits) may be voided meaning you start over under a new plan.

Q2: If I don’t pick a new plan, will I automatically be thrown into the “Standard Repayment”?

A: Many borrowers who don’t act risk being defaulted into the Standard plan fixed payments, higher monthly burden, no income-based relief.

Q3: Could private lenders or states step in to offer “SAVE-like” relief independently?

A: It’s theoretically possible (via state-funded forgiveness, grants, nonprofit programs), but unlikely to match the scale SAVE provided. Those programs tend to be limited, narrowly targeted, and not national in scope.

Q4: Does this mean student loan forgiveness initiatives are over for good?

A: Not necessarily forever but this move suggests forgiveness via executive orders is fragile. Long-term forgiveness likely requires legislation from Congress, not shifting policies.

Q5: What happens if my income drops drastically can I still get relief under the new plans?

A: Yes income-driven plans like IBR or PAYE adjust monthly payment amounts based on current income and family size. But even then, payments will likely be higher and forgiveness (if available) will take longer.

Table of Contents

- Global Markets on Edge- Tech Selloff, Fed Fears, and Iran Tensions Shake Investors-“But Opportunities Are Emerging. (Feb 2026)

- Milano Cortina 2026 Opens With Stunning and With Historic Opening Ceremony- But Critics Question Costs, Climate Impact or as the World Faces Division

- IRS Tax Refund 2026- Bigger Payments Coming for Some, but Delays Loom as Staffing Crisis Deepens

- Marvel’s Wolverine Has Massive Hype – But! Can Insomniac Really Deliver Its Darkest Game Yet? (Feb 2026)

- Fallout Countdown Falls Flat – “This Wasn’t What We Expected’ Fallout Countdown Backlash Erupts Online (Feb 2026)

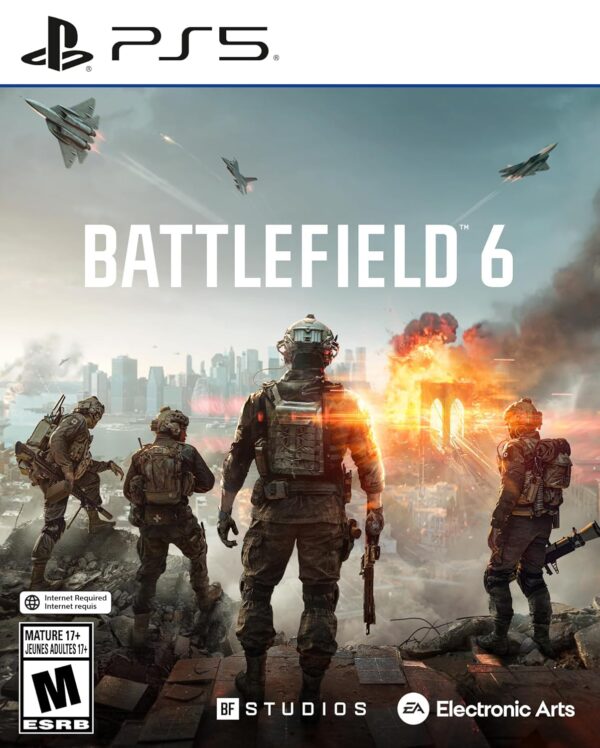

Battlefield 6 – Sony PlayStation 5

Product information

| UPC | 014633382143 |

|---|---|

| ASIN | B0FJHS8TH5 |

| Release date | October 10, 2025 |

| Customer Reviews |

4.5 out of 5 stars |

| Best Sellers Rank |

|

| Product Dimensions | 0.57 x 6.98 x 5.26 inches; 2.88 ounces |

| Type of item | Video Game |

| Language | English |

| Rated | Mature |

| Item model number | 38214 |

| Item Weight | 2.88 ounces |

| Manufacturer | Electronic Arts |

| Date First Available | July 31, 2025 |

Leave a Reply