What Maduro’s Capture Means for Chevron Stock

Chevron’s Century-Old Venezuela Bet Faces Its Biggest Test Yet

Introduction: A Shock That Shook Energy Markets

The capture and extraction of Venezuelan President Nicolás Maduro and his wife by U.S. forces marks one of the most dramatic geopolitical developments in Latin America in decades. Beyond the political shockwaves, the event has sent ripples through global energy markets, placing Chevron Corporation (CVX) Venezuela’s largest foreign investor squarely in the spotlight.

Chevron has operated in Venezuela for over 100 years, surviving coups, sanctions, nationalizations, and economic collapse. But Maduro’s sudden removal introduces a new and unpredictable phase, one that could either unlock long-term upside or expose Chevron to short-term operational and political risks.

This article explains what investors must know, what the hidden risks and opportunities are, and how Chevron stock could react in the days, weeks, and months ahead.

Why Chevron Is Still in Venezuela Despite U.S. Sanctions

The Sanctions Exception Explained

Chevron’s continued presence in Venezuela has long puzzled investors. The answer lies in carefully structured U.S. sanctions exemptions.

- Chevron operates under specific licenses issued by the U.S. Treasury’s Office of Foreign Assets Control (OFAC)

- These licenses allow Chevron to:

- Maintain assets

- Protect infrastructure

- Recover debt owed by PDVSA (Venezuela’s state oil company)

- Chevron cannot freely expand, but it can produce and export limited volumes

This arrangement made Chevron a strategic placeholder, positioning it to benefit if political conditions changed conditions that may now be shifting dramatically.

Venezuela’s Oil Importance, Why This Matters Globally

The Numbers That Matter

- Venezuela pumps ~900,000 barrels per day

- Chevron produces roughly 300,000 barrels per day (≈ one-third)

- Venezuela holds the world’s largest proven oil reserves

- Much of the oil is heavy crude, critical for U.S. Gulf Coast refineries

At a time when:

- OPEC spare capacity is thin

- Middle East tensions remain elevated

- Russia-Ukraine disruptions persist

Venezuelan oil represents a strategic pressure valve for global supply.

Immediate Market Impact, Chevron Stock and Oil Prices

Short-Term Reaction

In the immediate aftermath of the news:

- Chevron stock volatility increased

- Oil prices briefly spiked on supply disruption fears

- Energy equities saw defensive inflows

Investors are pricing in:

- Potential production interruptions

- Security risks to facilities

- Regulatory uncertainty over U.S. licenses

However, Chevron emphasized it is focused on employee safety and asset integrity, signaling operational continuity where possible.

Security Risks, Chevron’s Operations on Alert

What Chevron Is Watching Closely

Chevron confirmed heightened vigilance across:

- Oil fields

- Pipelines

- Export terminals

- Joint ventures with PDVSA

Key risks include:

- Labor strikes

- Sabotage or theft

- Power disruptions

- Political unrest during a leadership transition

Historically, periods of Venezuelan instability have led to temporary production declines, not total shutdowns important context for investors.

War and Geopolitical Spillovers

Regional and Global Implications

Maduro’s capture could:

- Trigger internal power struggles

- Invite regional interference

- Force China and Russia to reassess their Venezuela exposure

China and Russia both have financial and strategic stakes in Venezuelan energy, making this a multi-polar geopolitical flashpoint.

For the U.S., the event reshapes:

- Sanctions policy

- Energy diplomacy

- Latin American security strategy

Chevron sits at the intersection of all three.

What Happens Next? Three Possible Scenarios

Scenario 1: Orderly Transition (Bullish for Chevron)

- New interim government seeks legitimacy

- U.S. eases sanctions further

- Chevron expands production legally

- Long-term upside for CVX

📈 Stock impact: Strongly positive

Scenario 2: Prolonged Instability (Neutral to Bearish)

- Political vacuum

- Sporadic unrest

- Chevron maintains but cannot grow output

📉 Stock impact: Short-term pressure, long-term neutral

Scenario 3: Escalation or Asset Seizure (Bearish)

- Anti-U.S. backlash

- Contract disputes

- Asset access restricted

📉 Stock impact: Negative volatility spike

Christmas Period Timing, Why It Matters

The event comes during:

- Thin holiday liquidity

- Reduced institutional trading

- Higher volatility sensitivity

This means:

- Chevron stock moves may appear exaggerated

- Oil price swings could overshoot fundamentals

- News flow will drive sentiment more than earnings data

ltas Opinion Strategic Shock, Not Strategic Collapse

ltas Opinion Strategic Shock, Not Strategic Collapse

Altas View:

This is not the end of Chevron’s Venezuela strategy it may be the moment it was designed for.

Chevron stayed when others left precisely to benefit from a political reset. While near-term risks are real, Chevron’s:

- Legal positioning

- Asset quality

- U.S. government alignment

give it strategic leverage unmatched by competitors.

Investors should expect volatility, not abandonment.

Weekly Outlook, What to Watch

Key Catalysts

- U.S. Treasury statements on sanctions

- Chevron operational updates

- Venezuelan interim governance announcements

- Oil inventory and price reactions

Chevron Stock Forecast (Short-Term)

- Support zone: Long-term institutional buying levels

- Resistance: Near recent highs amid risk repricing

- Bias: Volatile but structurally resilient

FAQ’s

❓ Is Chevron pulling out of Venezuela?

No. Chevron has confirmed continued focus on safety and asset protection.

❓ Will U.S. sanctions be lifted now?

Not immediately, but selective easing is possible if a recognized transition occurs.

❓ Is Chevron stock risky right now?

Short-term volatility is elevated, but long-term fundamentals remain strong.

❓ Could oil prices spike further?

Yes, if Venezuelan output is disrupted or geopolitical tensions spread.

❓ Is this bullish or bearish for Chevron long term?

Potentially bullish, if political normalization follows.

Final Thoughts

Maduro’s capture is a historic inflection point for Venezuela and for Chevron. The company’s century-long presence, patient strategy, and regulatory positioning now face their most consequential test.

For investors, this is not just a headline it’s a case study in geopolitical risk, strategic patience, and energy security in a fragmented world.

Chevron’s Venezuela story is far from over.

Table of Contents

- NASA’s Artemis II Reaches the Launch Pad- A Historic Return to the Moon-With High Stakes and Unanswered Risks (January 2026)

- TFSA- “War, Inflation, and Market Volatility Rise-Yet TFSAs Remain One of Canada’s Safest Wealth Tools” (January 2026)

- UN at 80- UK Steps Forward to Support UN80 Reforms as Guterres Calls for Global Reset (January 2026)

- Canada EV Market Fell Off a Cliff-Now Chinese EVs and a Trump Endorsement Change the Game! (January 2026)

- The Rip a “Netflix’s Series, A Gritty Damon–Affleck Reunion That Could Redefine Streaming – Or Fade as Familiar Crime Fare” (January 2026)

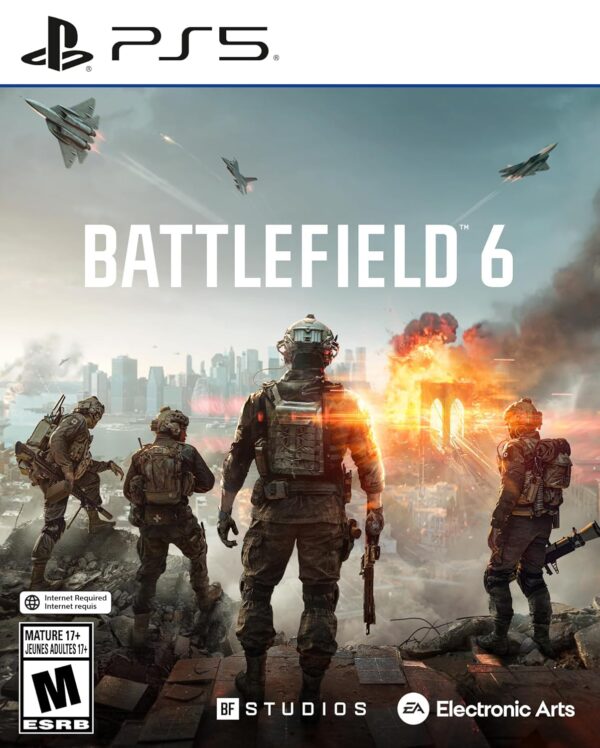

Battlefield 6 – Sony PlayStation 5

Product information

| UPC | 014633382143 |

|---|---|

| ASIN | B0FJHS8TH5 |

| Release date | October 10, 2025 |

| Customer Reviews |

4.5 out of 5 stars |

| Best Sellers Rank |

|

| Product Dimensions | 0.57 x 6.98 x 5.26 inches; 2.88 ounces |

| Type of item | Video Game |

| Language | English |

| Rated | Mature |

| Item model number | 38214 |

| Item Weight | 2.88 ounces |

| Manufacturer | Electronic Arts |

| Date First Available | July 31, 2025 |

Leave a Reply