Worried by the ATO’s new trust crackdown? Here’s what you can do Family Trust Elections, Interposed Entities, and the trapdoors to avoid

Description

The ATO is targeting family trusts, FTEs and IEEs more aggressively. Read an in-depth guide on what Family Trust Elections and Interposed Entity Elections mean, the risks (including Family Trust Distribution Tax), practical steps trustees should take today, and Altas Opinion on how to respond. Citations to official ATO guidance included.

Introduction why this matters now

The Australian Taxation Office (ATO) has renewed focus on private trust arrangements, particularly family trust elections (FTEs), interposed entity elections (IEEs) and how trustees use trusts to manage distributions. Recent compliance activity and guidance show the ATO is doing deeper audits and won’t hesitate to impose Family Trust Distribution Tax (FTD tax) where it considers distributions were made outside the defined family group. If you are a trustee, a beneficiary or an adviser, a careless election or sloppy record-keeping can produce a nasty tax bill and retrospective interest. See official ATO guidance on family trusts for details. (Australian Taxation Office)

Quick primer core concepts explained simply

- Family Trust Election (FTE): a formal choice a trustee can make which fixes a “specified individual” and defines the trust’s “family group” for tax rules; once made it can have lasting consequences and can be hard to reverse. (Australian Taxation Office)

- Interposed Entity Election (IEE): used where entities are interposed between a family trust and ultimate family members; an IEE can bring those entities within the family group for tax purposes or exclude them if mis-applied. (Australian Taxation Office)

- Family Trust Distribution Tax (FTD tax): if a trust confers present entitlements on people outside the family group (or transfers to non-group entities), the trustee may be liable for a punitive tax (effectively the top marginal rate plus Medicare). Recent enforcement shows large historical assessments are possible. (Cleardocs)

What has changed the ATO’s renewed focus

Over the past 12–24 months the ATO has amplified review activity on trust groups. That means: more audits, closer scrutiny of historical elections, and an emphasis on whether trustees actually satisfied the statutory “family control” and “family group” tests when an election was made. Several professional advisers and law firms have reported increased ATO enquiries and, in some cases, assessments and interest charges where the ATO determined elections were invalid or distributions were to non-family persons. (Cleardocs)

Why now? The ATO’s public materials and commentary indicate a priority to ensure tax integrity and curb perceived misuse of trusts for income splitting and tax avoidance. That’s translated into more documentary requests and tougher positions in audits. (Cleardocs)

Family trust elections one choice, lasting consequences

Making an FTE is not a casual step. Key practical realities:

- Irrevocability and timing: While some variations and revocations are possible, an election’s effective date and the statutory tests at that time are critical. If you made an FTE in a year when the trust did not meet the family control test, the election may be vulnerable. The ATO’s forms and instructions are precise about the information required. (Australian Taxation Office)

- Choice of the specified individual matters: the “specified individual” defines who belongs to the family group. Choosing the wrong person (or failing to document relationships and control) can open you to FTD tax. (Australian Taxation Office)

- Record-keeping is evidence: the ATO will test historical facts meeting minutes, distribution minutes, trust deeds, correspondence and whether apparent control was genuine. Poor records weaken your position. (Cleardocs)

Interposed entity elections common pitfalls

Many family structures use intermediary companies, trusts or partnerships. If those interposed entities aren’t properly brought within the family group by an IEE (or are incorrectly included), the trustee can be exposed to FTD tax on distributions to those entities. Recent commentary suggests IEEs are one of the more technical and error-prone parts of compliance. Professional advice is often required. (Pointon Partners)

Trust tax traps real risks trustees must not ignore

- Accidental distributions: distributions intended for family beneficiaries but routed through non-group entities (e.g. a corporate service entity) can trigger FTD tax. (Cleardocs)

- Family breakdowns and former family members: the definition of “family group” includes ex-spouses and other relationships in certain cases so changes in family circumstances can retrospectively affect whether a distribution was to a non-group person. (MYOB Practice Support)

- Late or poorly drafted FTEs/IEEs: incorrectly completed forms or electing in years the control test wasn’t satisfied gives the ATO ammunition in audits. (Australian Taxation Office)

- Interest and retrospective tax: where the ATO finds non-compliance, penalties, General Interest Charge (GIC) and the high FTD tax rate can produce very large historical liabilities. (Cleardocs)

Practical checklist what trustees should do today

- Do a governance and document audit now: gather trust deeds, minutes, distribution resolutions, copies of FTEs/IEEs and beneficiary registers. Confirm who the specified individual(s) is/was for each year. (Australian Taxation Office)

- Map the family group and interposed entities: create a simple diagram showing entities, individuals, and how distributions flow. This helps advisers test whether IEEs were needed or valid. (Pointon Partners)

- Check historic elections for technical validity: compare the timing of elections to evidence of family control. If you find mistakes, discuss revocation/variation options with a tax lawyer but be aware of statutory constraints. (Australian Taxation Office)

- Improve record-keeping going forward: minute every distribution decision, keep correspondence that supports commercial reasons for distributions, and maintain clear beneficiary resolutions. Good records are your defensive armour. (Cleardocs)

- Seek specialist advice before making new elections: where an FTE or IEE might be beneficial, get independent tax/legal advice these are not “DIY” forms. (Cleardocs)

ltas Opinion

ltas Opinion

The ATO’s focus is a reality check. While FTEs and IEEs are legitimate tax instruments, their value depends entirely on correct administration and genuine underlying facts (control, family relationships, commercial purpose). In practice, small family offices and advisers have historically treated these elections as routine. That era is ending.

My view: trustees should treat FTE/IEE decisions as strategic corporate governance choices, not mere tax paperwork. Make the election only after: (a) mapping real control and family relationships; (b) documenting commercial reasons for distributions; and (c) considering whether the potential benefits outweigh the compliance risk. Where there is ambiguity, favour transparency with the ATO or obtain a private ruling it may cost, but it avoids far larger retrospective risks.

FAQ’s

Q1: If my trustee made an FTE years ago but I can’t find supporting minutes, can the ATO disallow it?

A1: Yes. The ATO will examine whether the statutory tests were satisfied at the relevant time. Without contemporaneous records demonstrating control and appropriate processes, the ATO’s position will be stronger. Start reconstructing evidence now and speak to an advisor about disclosure options. (Cleardocs)

Q2: Can I revoke an FTE to escape a past mistake?

A2: Revocation is possible in limited circumstances, but revocation doesn’t erase events that already happened. If the ATO has grounds for an assessment for past years, revocation may not eliminate liability for past distributions. (Australian Taxation Office)

Q3: If an interposed company is used for genuine business operations, will that protect us?

A3: Substance matters. If the interposed entity genuinely acts as a commercial intermediary and meets IEE criteria, risk can be mitigated. But where an entity exists merely as a conduit for distribution splitting, the ATO may recharacterise the arrangement. (Pointon Partners)

Q4: What if the ATO contacts us should we disclose proactively?

A4: Proactive disclosure can reduce penalties and interest in some cases and demonstrates good faith. Professional advice should guide any voluntary disclosure. (Cleardocs)

Q5: Unique-FAQ: If a trustee paid a family member’s living expenses directly (no distribution minutes), is that a distribution?

A5: Yes, benefits provided that are effectively for a beneficiary’s personal use can be treated as distributions. Lack of formal distribution minutes won’t prevent the ATO from treating the benefit as income or capital distributed. Document everything and treat in-kind benefits as taxable events where appropriate. (Cleardocs)

Bottom line & next steps

The ATO is serious trustees should be too. Start with a document and governance audit, map family/control relationships, and speak with a specialist tax lawyer or accountant before making or changing elections. If you discover past errors, don’t bury your head consider professional advice on disclosure and remediation options.

Useful official links (for trustees & advisers)

- ATO — Family trusts overview. (Australian Taxation Office)

- ATO — Family trust election, revocation or variation instructions (2025). (Australian Taxation Office)

- ATO — Interposed entity election instructions (2025). (Australian Taxation Office)

Table of Contents

- Resident Evil Requiem Becomes 2026’s Highest-Rated Game – A Survival Horror Masterpiece or an Overhyped Sequel That Loses Steam?

- Black Ops 7 Sets a New Standard for Tactical FPS Combat – But Controversy and Matchmaking Frustrations Spark Debate

- Ghostrunner 2 Free on Epic Games, A Cyberpunk Masterpiece of Relentless Action – or a Brutally Punishing Game That’s Too Hard to Love?

- Code Vein II Is a Beautiful Evolution – But Its Uneven World Holds It Back! Or Does It Still Lack the Crown? (Feb 2026)

- Nioh 3 Review- A Brutal Soulslike Masterpiece That Perfects Samurai Combat – Or an Unforgiving Grind That Pushes Players Too Far?

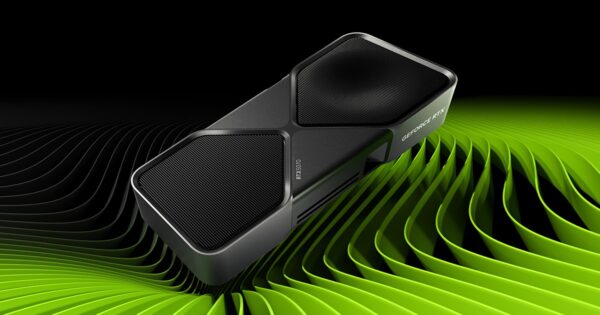

NVIDIA – GeForce RTX 5070 12GB GDDR7 Founders Edition Graphics Card – Graphite Grey

GeForce RTX 5070 Family

| GeForce RTX 5070 Ti | GeForce RTX 5070 | ||

|---|---|---|---|

| GPU Engine Specs: | NVIDIA CUDA® Cores | 8960 | 6144 |

| Shader Cores | Blackwell | Blackwell | |

| Tensor Cores (AI) | 5th Generation 1406 AI TOPS |

5th Generation 988 AI TOPS |

|

| Ray Tracing Cores | 4th Generation 133 TFLOPS |

4th Generation 94 TFLOPS |

|

| Boost Clock (GHz) | 2.45 | 2.51 | |

| Base Clock (GHz) | 2.3 | 2.33 | |

| Memory Specs: | Standard Memory Config | 16 GB GDDR7 | 12 GB GDDR7 |

| Memory Interface Width | 256-bit | 192-bit | |

| Technology Support: | NVIDIA Architecture | Blackwell | Blackwell |

| Ray Tracing | Yes | Yes | |

| NVIDIA DLSS | DLSS 4 Super Resolution DLAA Ray Reconstruction Frame Generation Multi Frame Generation |

DLSS 4 Super Resolution DLAA Ray Reconstruction Frame Generation Multi Frame Generation |

|

| NVIDIA Reflex | Reflex 2 Low Latency Mode Frame Warp (Coming Soon) |

Reflex 2 Low Latency Mode Frame Warp (Coming Soon) |

|

| NVIDIA Broadcast | Yes | Yes | |

| PCI Express Gen 5 | Yes | Yes | |

| Resizable BAR | Yes | Yes | |

| NVIDIA App | Yes | Yes | |

| Photo Mode | Yes | Yes | |

| NVIDIA FreeStyle | Yes | Yes | |

| NVIDIA ShadowPlay | Yes | Yes | |

| NVIDIA Highlights | Yes | Yes | |

| NVIDIA G-SYNC® | Yes | Yes | |

| Game Ready Drivers | Yes | Yes | |

| NVIDIA Studio Drivers | Yes | Yes | |

| NVIDIA Omniverse | Yes | Yes | |

| RTX Remix | Yes | Yes | |

| Microsoft DirectX® 12 Ultimate | Yes | Yes | |

| NVIDIA GPU Boost™ | Yes | Yes | |

| NVIDIA NVLink™ (SLI-Ready) | No | No | |

| Vulkan 1.4, OpenGL 4.6 | Yes | Yes | |

| NVIDIA Encoder (NVENC) | 2x Ninth Generation | 1x Ninth Generation | |

| NVIDIA Decoder (NVDEC) | 1x Sixth Generation | 1x Sixth Generation | |

| AV1 Encode | Yes | Yes | |

| AV1 Decode | Yes | Yes | |

| CUDA Capability | 12.0 | 12.0 | |

| VR Ready | Yes | Yes | |

| Display Support: | Maximum Digital Resolution(1) | 4K at 480Hz or 8K at 165Hz with DSC | 4K at 480Hz or 8K at 165Hz with DSC |

| Standard Display Connectors | 3x DisplayPort(2), 1x HDMI(3) | 3x DisplayPort(2), 1x HDMI(3) | |

| Multi Monitor | up to 4(4) | up to 4(4) | |

| HDCP | 2.3 | 2.3 | |

| Card Dimensions: | Length | Varies by manufacturer | 242 mm |

| Width | Varies by manufacturer | 112 mm | |

| Slots | Varies by manufacturer | 2-Slot | |

| SFF-Ready Enthusiast GeForce Card | Varies by manufacturer | Founders Edition Yes Varies by manufacturer |

|

| Thermal and Power Specs: | Maximum GPU Temperature (in C) | 88 | 85 |

| Total Graphics Power (W) | 300 | 250 | |

| Required System Power (W) (5) | 750 | 650 | |

| Supplementary Power Connectors | 2x PCIe 8-pin cables (adapter in box) OR 300 W or greater PCIe Gen 5 cable |

2x PCIe 8-pin cables (adapter in box) OR 300 W or greater PCIe Gen 5 cable |

1 – Up to 4K 12-bit HDR at 480Hz with DP 2.1b + DSC or HDMI 2.1b +DSC. Up to 8K 12-bit HDR at 165Hz with DP 2.1b + DSC. Up to 8K 12-bit HDR at 120Hz With HDMI 2.1b + DSC. With dual DP 2.1b + DSC, up to 8K HDR at 100Hz

2 – DisplayPort 2.1b with UHBR20: up to 4K 480Hz or 8K 165Hz with DSC

3 – As specified in HDMI 2.1b: up to 4K 480Hz or 8K 120Hz with DSC, Gaming VRR, HDR

4 – Multi Monitor:

- 4 independent displays at 4K 165Hz using DP or HDMI

- 2 independent displays at 4K 360Hz or 8K 100Hz with DSC using DP or HDMI

- Other display configurations may be possible based on available bandwidth

5 – Minimum is based on a PC configured with a Ryzen 9 9950X processor. Recommend PCIe CEM 5.1 compliant PSU. Power requirements can be different depending on system configuration.

Note: The above specifications represent this GPU as incorporated into NVIDIA’s Founders Edition or reference graphics card design. Clock specifications apply while gaming with medium to full GPU utilization. Graphics card specifications may vary by add-in-card manufacturer. Please refer to the add-in-card manufacturers’ website for actual shipping specifications.

RTX. It’s On.

The Ultimate in Ray Tracing and AI

RTX is the most advanced platform for full ray tracing and neural rendering technologies that are revolutionizing the ways we play and create. Over 700 games and applications use RTX to deliver realistic graphics and incredibly fast performance with cutting-edge AI features like DLSS Multi Frame Generation.

NVIDIA DLSS 4

Supreme Speed. Superior Visuals. Powered by AI.

DLSS is a revolutionary suite of neural rendering technologies that uses AI to boost FPS, reduce latency, and improve image quality. The latest breakthrough, DLSS 4, brings new Multi Frame Generation and enhanced Ray Reconstruction and Super Resolution, powered by GeForce RTX™ 50 Series GPUs and fifth-generation Tensor Cores. DLSS on GeForce RTX is the best way to play, backed by an NVIDIA AI supercomputer in the cloud constantly improving your PC’s gaming capabilities.

GeForce RTX 5090, 4K, RT Overdrive, Max Settings, DLSS with Multi Frame Generation (4X Mode), Ray Reconstruction, Super Resolution (Performance Mode)

Full Ray Tracing With Neural Rendering

Game-Changing Realism

The NVIDIA Blackwell architecture unlocks the game-changing realism of full ray tracing. Experience cinematic quality visuals at unprecedented speed powered by GeForce RTX 50 Series with fourth-gen RT Cores and breakthrough neural rendering technologies accelerated with fifth-gen Tensor Cores.

NVIDIA Reflex 2

Compete at Warp Speed

Reflex technologies optimize the graphics pipeline for ultimate responsiveness, providing faster target acquisition, quicker reaction times, and improved aim precision in competitive games. Reflex 2 introduces Frame Warp (coming soon!), which further reduces latency based on the game’s latest mouse input.

RTX AI PCs

NVIDIA Powers the World’s AI. And Yours.

Upgrade to advanced AI with NVIDIA GeForce RTX™ GPUs and accelerate your gaming, creating, productivity, and development. Thanks to built-in AI processors, you get world-leading AI technology powering your Windows PC.

Leave a Reply