Panama at a Crossroads- Ports, Power, Copper, and Global Influence in a Shifting Geopolitical Order

Introduction- Why Panama Matters More Than Ever

Panama has quietly become one of the most strategically contested economic hubs in the world. Once viewed primarily as a logistics corridor, the country now sits at the intersection of global trade, energy security, China–U.S. rivalry, critical minerals supply chains, and investor confidence in emerging markets.

From the fate of the Cobre Panamá copper mine, to a potentially historic ruling on Panama Canal port concessions controlled by a Chinese-linked operator, to redesigned energy tenders and rising bunker fuel demand, Panama’s decisions in 2025–2026 could reshape trade flows far beyond Latin America.

Panamanian officials insist the message is simple: transparency, rule of law, and predictable business frameworks. But the stakes are anything but simple.

Panama Signals Openness- “Clear Rules, Transparent Markets”

Panama’s Minister of Commerce and Industry, Julio Moltó, recently reaffirmed that Panama welcomes international partners including Italy and European investors-under clear, transparent, and rules-based frameworks.

This is not just diplomatic language. It is a direct response to:

- Rising investor caution after past legal disputes

- Concerns over regulatory uncertainty

- Intensifying scrutiny from the U.S. and EU over Chinese-linked infrastructure

By emphasizing legal clarity, Panama is positioning itself as a neutral but reliable platform for global capital at a time when supply chains are fragmenting and “friend-shoring” is accelerating.

The Cobre Panamá Copper Mine- A June Decision with Global Impact

Why Cobre Panamá Matters

The Cobre mine Panama, operated by First Quantum Minerals, is one of the largest copper mines in the world and a key supplier to:

- Electric vehicles

- Renewable energy grids

- Defense and industrial manufacturing

Copper is now a strategic mineral, not just a commodity.

What’s Happening Now

- Panama’s government has confirmed it will rule by June on the future of the shuttered mine.

- First Quantum has backed Panama’s plan to allow processing of existing copper stockpiles.

- This approach avoids immediate mine reopening while preserving economic value.

The Hidden Angle

Allowing stockpile processing:

- Reduces environmental and political backlash

- Generates fiscal revenue without full-scale operations

- Buys time as copper prices remain structurally tight

In a world racing toward electrification, Panama’s copper decision will ripple through global supply chains.

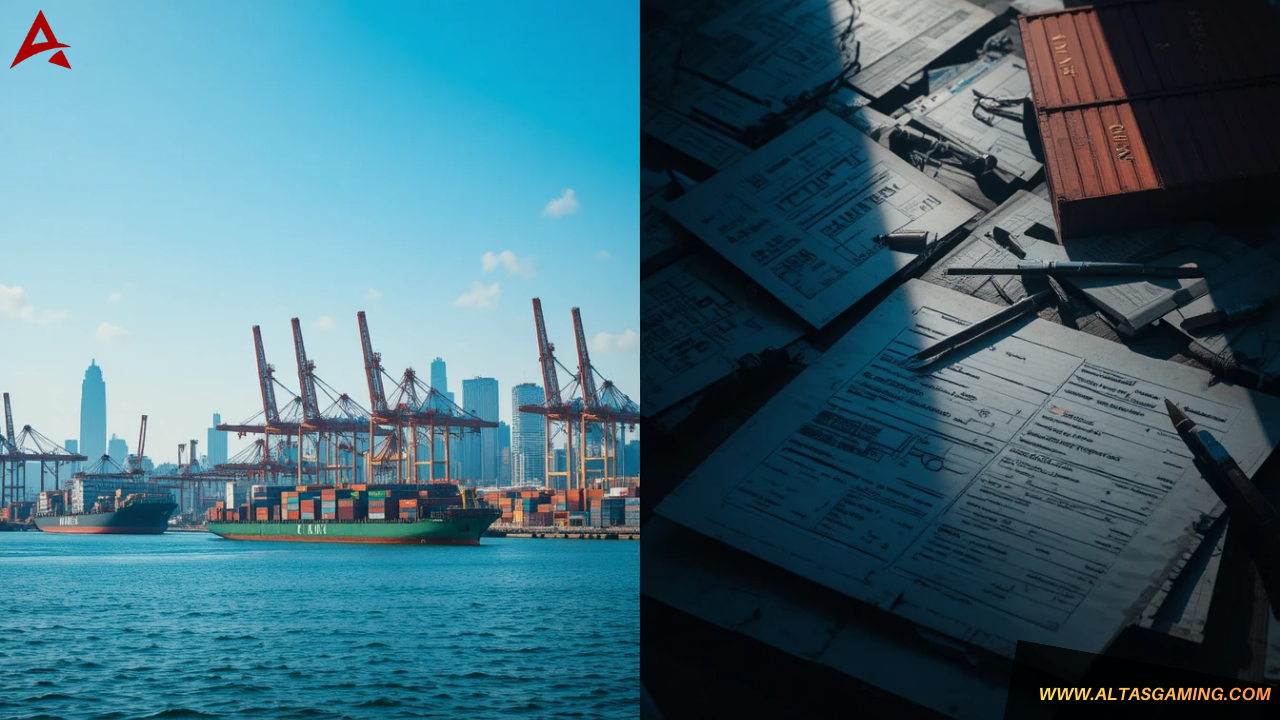

The Panama Canal Ports Showdown- China, the U.S., and a Courtroom Battle

What’s at Stake

Panama’s Supreme Court is nearing a ruling that could:

- Void the license of CK Hutchison, a Hong Kong-based conglomer with Chinese links

- Block or reshape a $23 billion ports deal involving BlackRock and MSC

- Redefine who controls critical access points to the Panama Canal

This is not just a legal case it is a geopolitical flashpoint.

China Pushes Back

China has reportedly warned it may:

- Block the ports sale unless COSCO, a Chinese state-linked shipping giant, receives a stake

- Treat exclusion as a strategic affront

Why the U.S. Is Watching Closely

If the license is voided:

- It could be framed as a win for U.S. strategic interests

- It would reduce China’s footprint near one of the world’s most critical maritime chokepoints

- President Trump could claim success in countering Chinese infrastructure dominance

This case underscores how courts, not battlefields, are now shaping global power.

Energy Sector Reset- Power Tender Redesign Restores Confidence

Panama’s energy market is undergoing a quiet but crucial transformation.

The World Energy Council (WEC) Panama chapter says redesigned power tenders:

- Encourage new market entrants

- Increase competition

- Deliver more affordable electricity prices

Why This Matters

Energy costs influence:

- Manufacturing competitiveness

- Logistics operations

- Data centers and digital infrastructure

By reforming auction schemes, Panama is signaling to investors that it understands the next phase of energy economics, especially as renewables, LNG, and grid stability converge.

Panama’s Bunker Market- A Silent Growth Engine

In 2025, Panama’s bunker fuel market recorded 4.1% annual sales growth.

This matters because:

- The Panama Canal remains a critical refueling hub

- Global shipping disruptions have increased strategic stopovers

- Cleaner fuel standards are reshaping bunker demand

Despite geopolitical tensions, Panama’s maritime services sector continues to expand, reinforcing its role as a logistics powerhouse.

Trade, Tariffs, and Strategic Neutrality

Panama’s challenge is not choosing sides but surviving great-power competition without becoming collateral damage.

Key risks include:

- Trade retaliation linked to port decisions

- Pressure from China on infrastructure deals

- U.S. expectations around security alignment

Yet Panama’s strategy appears consistent:

- Anchor decisions in domestic law

- Use courts, not executive decrees

- Maintain investor neutrality

This approach may frustrate all sides but it protects sovereignty.

Forecast- What Happens Next?

Short-Term (2025–Mid 2026)

- Supreme Court ruling reshapes port ownership

- Copper stockpile processing begins

- Energy tenders attract new regional players

Medium-Term (2026–2028)

- Panama emerges as a test case for managing China–U.S. rivalry

- Copper becomes a renewed pillar of fiscal stability

- Canal-related services grow amid global trade rerouting

Risk Scenario

- Legal uncertainty or political backlash could delay investments

- External pressure escalates if rulings disfavor major powers

ltas Opinion- Panama’s Quiet Power Play

ltas Opinion- Panama’s Quiet Power Play

Panama is not posturing it is rebalancing.

By insisting on:

- Courts over politics

- Transparency over favoritism

- Incremental reforms over dramatic shifts

Panama is crafting a model for small but strategic nations navigating a multipolar world. The real test is not whether Panama chooses China or the U.S., but whether it can enforce its own rules without compromise.

So far, the signs are cautiously positive.

FAQ’s

Why is the Panama Canal ports issue so sensitive?

Because control of canal-adjacent ports affects global shipping, military logistics, and great-power influence.

Is Panama anti-China?

No. Panama is attempting to reassert regulatory sovereignty, not exclude any one country.

Why is copper so critical now?

Copper underpins EVs, renewables, grids, and defense systems making it a strategic asset.

Will Panama reopen the Cobre Panamá mine?

A full reopening is uncertain, but stockpile processing is a significant interim step.

How does energy reform affect ordinary citizens?

More competitive tenders can lower electricity costs and improve grid reliability.

Final Thought

Panama is no longer just a canal it is a decision-maker in the global system. And in today’s world, how a country decides matters as much as what it decides.

Table of Contents

- Resident Evil Requiem Becomes 2026’s Highest-Rated Game – A Survival Horror Masterpiece or an Overhyped Sequel That Loses Steam?

- Black Ops 7 Sets a New Standard for Tactical FPS Combat – But Controversy and Matchmaking Frustrations Spark Debate

- Ghostrunner 2 Free on Epic Games, A Cyberpunk Masterpiece of Relentless Action – or a Brutally Punishing Game That’s Too Hard to Love?

- Code Vein II Is a Beautiful Evolution – But Its Uneven World Holds It Back! Or Does It Still Lack the Crown? (Feb 2026)

- Nioh 3 Review- A Brutal Soulslike Masterpiece That Perfects Samurai Combat – Or an Unforgiving Grind That Pushes Players Too Far?

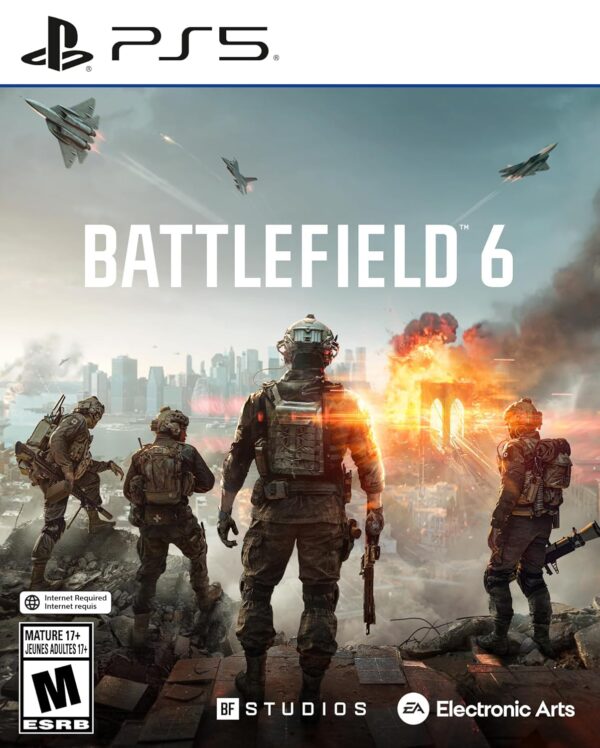

Battlefield 6 – Sony PlayStation 5

Product information

| UPC | 014633382143 |

|---|---|

| ASIN | B0FJHS8TH5 |

| Release date | October 10, 2025 |

| Customer Reviews |

4.5 out of 5 stars |

| Best Sellers Rank |

|

| Product Dimensions | 0.57 x 6.98 x 5.26 inches; 2.88 ounces |

| Type of item | Video Game |

| Language | English |

| Rated | Mature |

| Item model number | 38214 |

| Item Weight | 2.88 ounces |

| Manufacturer | Electronic Arts |

| Date First Available | July 31, 2025 |

Leave a Reply