💰 Where to Invest Your $7,000 TFSA in 2026- Smart Strategies to Grow Wealth Tax-Free

CRA confirms the 2026 TFSA limit here’s how to invest $7,000 wisely, grow wealth tax-free, build income, and protect your portfolio amid global uncertainty.

🇨🇦 TFSA 2026- What the CRA Has Confirmed

The Canada Revenue Agency (CRA) has confirmed that the TFSA contribution limit for 2026 is $7,000, bringing the total lifetime contribution room to $102,000 for Canadians who have been eligible since inception.

That number isn’t just a statistic it’s a massive tax-free opportunity.

Every dollar of growth, dividends, and capital gains inside a TFSA is:

- ✅ Completely tax-free

- ✅ Not counted as income

- ✅ Safe from future tax hikes

In a world of rising deficits, war spending, and trade instability, that matters more than ever.

📈 Why TFSAs Matter More in 2026 Than Ever Before

We are entering a period defined by:

- Higher interest rates (even if cuts begin)

- Persistent global conflicts

- Trade fragmentation and tariffs

- Government pressure to raise future taxes

A TFSA is one of the last truly protected shelters Canadian investors have.

Unlike RRSPs:

- Withdrawals are not taxable

- Withdrawals don’t affect government benefits

- You can redeploy capital anytime

🏦 Where to Invest Your $7,000 TFSA Contribution for Long-Term Gains

🥇 1. Canadian Equity ETFs (The Core Foundation)

For most investors, a broad Canadian equity ETF should be the backbone of a TFSA.

Why?

- Canada’s banks, utilities, pipelines, and telecoms are dividend machines

- Many pay 4%–7% yields

- Dividends grow over time tax-free inside a TFSA

Hidden advantage:

Canadian dividends compound faster in a TFSA than in a taxable account, where dividend tax credits still leave leakage.

🌎 2. Growth ETFs- Turn $20,000 Into $75,000 (Realistic Scenario)

Long-term compounding is powerful.

Example strategy:

- $20,000 TFSA invested in a diversified growth ETF

- Average annual return: ~9%

- Time horizon: ~15 years

👉 Result: ~$75,000 tax-free

This isn’t fantasy it’s math.

Growth ETFs benefit from:

- AI adoption

- Automation

- Clean energy

- Healthcare innovation

And all gains remain untouched by the CRA.

🧠 3. Why Canadian Stocks Should Still Be Your First Choice

Despite global hype, Canadian stocks remain ideal for TFSAs.

Reasons many overlook:

- Stable regulation

- Strong dividend culture

- Oligopoly markets (banks, telecoms, rail)

- Lower volatility than U.S. tech

In uncertain geopolitical times, boring beats flashy.

💸 Income Strategy- How to Earn $146 Per Month From a $25,000 TFSA

Let’s break it down.

Target: $146/month

Annual income needed: ~$1,752

That requires roughly a 7% yield.

Example TFSA income mix:

- Canadian bank stocks

- Utility companies

- Infrastructure ETFs

- Covered-call ETFs (used carefully)

Key insight:

Because income is tax-free, a 7% TFSA yield is equivalent to 9–10% pre-tax income outside a TFSA.

That’s powerful.

🌍 War, Trade, and Tariffs- How Global Risk Should Shape Your TFSA

Global tensions are not background noise they directly affect returns.

What this means for TFSA investors:

- Defense and infrastructure spending supports dividends

- Energy security keeps Canadian resource firms relevant

- Trade fragmentation favors domestic producers

Strategy shift:

Balance growth with cash-generating assets that can survive shocks.

🔮 TFSA Forecast- What to Expect Over the Next Decade

Near-Term (2026–2028)

- Volatility remains elevated

- Dividend stocks outperform in risk-off markets

- Select growth rebounds

Mid-Term (2029–2035)

- Compounding becomes visible

- Income snowballs

- TFSA balances quietly outpace RRSPs for many investors

Long-Term

- TFSAs become the most politically protected investment vehicle

- Tax advantages become more valuable as governments search for revenue

🎙️  lta’s Opinion

lta’s Opinion

Most Canadians underuse their TFSA.

They chase short-term trades or let cash sit idle both are mistakes.

My view:

- A TFSA should be boring, disciplined, and patient

- Growth + income beats speculation

- Canadian assets deserve more respect than they get

If governments raise taxes in the future (and they will),

your TFSA will already be one step ahead.

❓ FAQ’s

Q1. Should I max my TFSA before investing elsewhere?

Yes especially before taxable accounts.

Q2. Is it risky to hold high-yield ETFs in a TFSA?

Only if concentration is ignored. Diversification matters more than yield.

Q3. Can I day-trade inside a TFSA?

Technically yes, but frequent trading risks CRA scrutiny.

Q4. Should young investors focus on growth or income?

Growth first, income later but both can coexist.

Q5. Do global conflicts make TFSAs more important?

Yes. Volatility increases the value of tax-free compounding.

Q6. Is a TFSA better than an RRSP for most people?

For flexibility and future tax uncertainty often yes.

Q7. What’s the biggest hidden TFSA mistake?

Letting contribution room go unused.

🧾 Final Takeaway

A $7,000 TFSA contribution in 2026 isn’t small it’s strategic.

Used correctly, it can:

- Grow quietly into six figures

- Generate lifelong tax-free income

- Protect you from future tax changes

In an unstable world, the TFSA remains one of Canada’s most powerful and underappreciated financial tools.

Table of Contents

- Resident Evil Requiem Becomes 2026’s Highest-Rated Game – A Survival Horror Masterpiece or an Overhyped Sequel That Loses Steam?

- Black Ops 7 Sets a New Standard for Tactical FPS Combat – But Controversy and Matchmaking Frustrations Spark Debate

- Ghostrunner 2 Free on Epic Games, A Cyberpunk Masterpiece of Relentless Action – or a Brutally Punishing Game That’s Too Hard to Love?

- Code Vein II Is a Beautiful Evolution – But Its Uneven World Holds It Back! Or Does It Still Lack the Crown? (Feb 2026)

- Nioh 3 Review- A Brutal Soulslike Masterpiece That Perfects Samurai Combat – Or an Unforgiving Grind That Pushes Players Too Far?

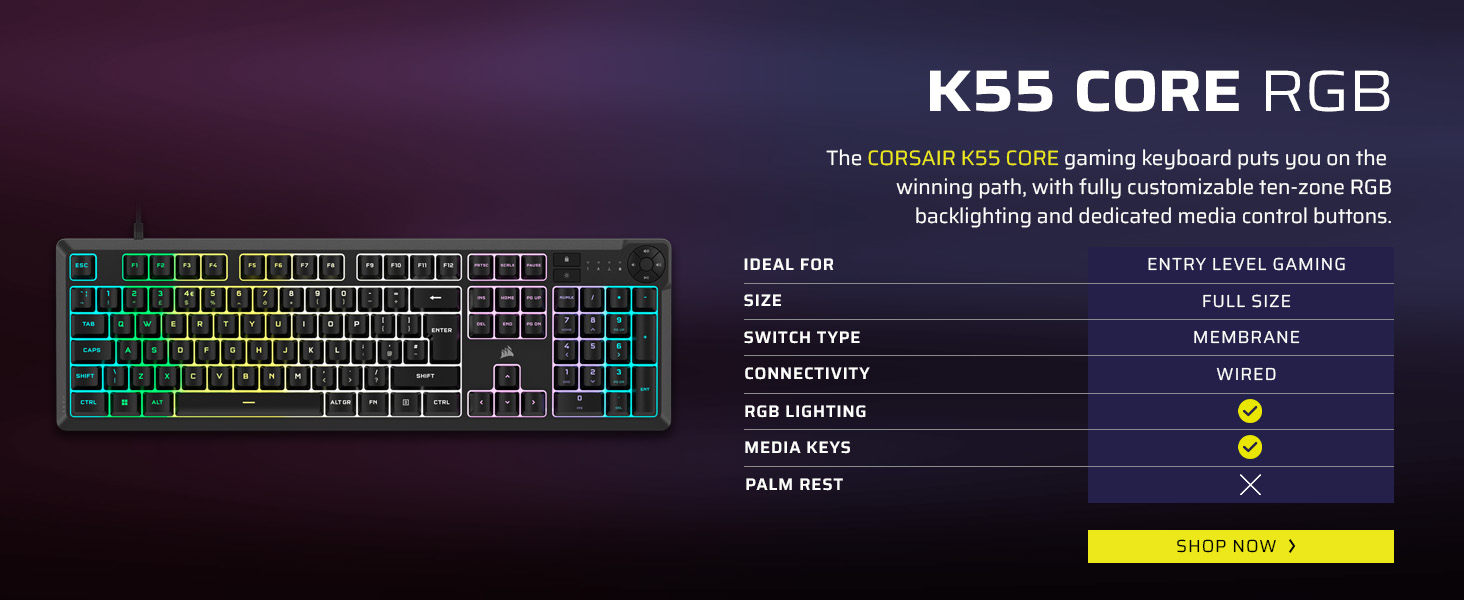

Corsair K70 PRO TKL RGB

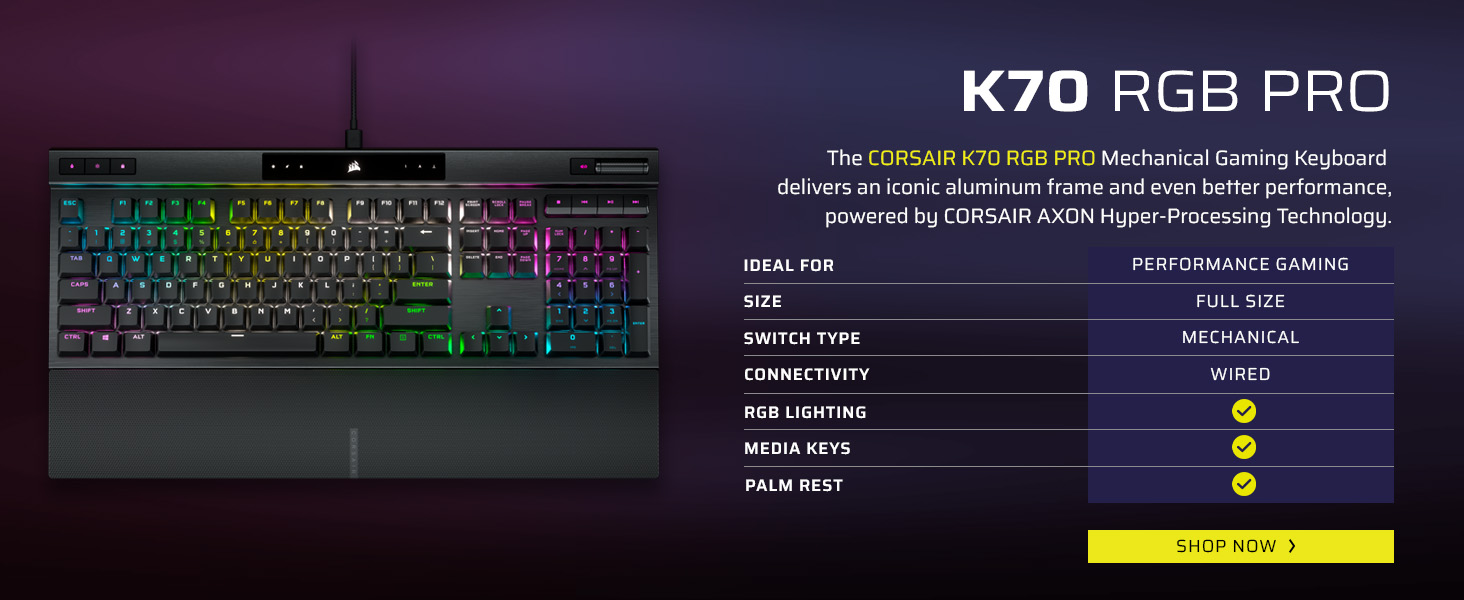

Corsair K70 PRO

About this item

- Speed is Everything: It’s all about speed. With Rapid Trigger, ultra-fast polling rates, and per-key adjustable switches, K70 PRO TKL removes every barrier that comes between you and gaming greatness

- Space-Saving Tenkeyless Layout: The sleek, streamlined tenkeyless layout fits in nearly every gaming setup, while leaving room for sweeping mouse movements

- MGX Hyperdrive Magnetic Switches*: Pre-lubricated CORSAIR MGX Hyperdrive magnetic switches deliver a smooth, ultra-responsive keypress. Its sturdy double-rail structure reduces wobble and guarantees peak performance for 150 million keystrokes. *Function keys and non-primary keys feature CORSAIR MLX switches

- Rapid Trigger Advantage: Rapid Trigger dynamically changes your keys’ actuation and reset points, so you can move and reset your movements faster than ever

- Customizable Per-Key Actuation: Adjust the actuation point of each key from a super-sensitive 0.4mm to a deep 3.6mm (in 0.1mm steps) or set two actions to a single keypress with dual actuation for quick-fire combos and action pairs.

Leave a Reply