JPMorgan and Bank of America Back “Trump Accounts” A New Financial Experiment That Could Reshape Family Savings in the U.S.

Introduction- A Political Idea Turning Into a Financial Movement

In a surprising convergence of politics, finance, and family economics, JPMorgan Chase and Bank of America have announced plans to match up to $1,000 in government contributions for employee participation in so-called “Trump Accounts.”

What began as a politically charged concept is rapidly evolving into a mainstream financial tool especially for children and families sparking debate across Wall Street, Washington, and social media platforms like Facebook.

Supporters call it a revolutionary savings strategy. Critics warn it could deepen inequality and politicize personal finance.

But what exactly are Trump Accounts, and why are America’s biggest banks embracing them?

What Are “Trump Accounts”?

A Trump Account is a proposed government-backed savings or investment account designed to:

- Encourage long-term savings for children and families

- Provide tax advantages

- Combine public funding with private-sector matching

- Promote financial independence from an early age

Under the latest proposals:

- The U.S. government deposits up to $1,000 into eligible accounts.

- Major banks like JPMorgan and Bank of America match the amount for employees.

- Families are encouraged to open similar accounts for children.

- Funds can be used for education, housing, or retirement in the future.

This makes Trump Accounts similar to a hybrid of:

- 529 college savings plans

- Roth IRAs

- Child trust funds

- Universal basic asset programs

Why Are JPMorgan and Bank of America Supporting It?

1) Corporate Strategy- Winning the Talent War

For banks, matching Trump Account contributions is not just political it’s strategic.

- Employee benefits are becoming a key battleground.

- Gen Z and Millennials demand long-term financial security.

- Offering matched savings boosts retention and loyalty.

A senior financial analyst explained:

“This is not about ideology. It’s about talent, branding, and future-proofing the workforce.”

2) Market Opportunity- The “Kids Finance” Boom

Trump Accounts for children could unlock a massive market.

If even 20% of U.S. families adopt them:

- Millions of new accounts could be created.

- Banks could manage trillions in long-term assets.

- Fintech companies could integrate new digital tools.

Facebook and other social platforms are already flooded with discussions about:

- “Kids Trump accounts”

- “Best savings accounts for children”

- “Is Trump Account worth it?”

Trump’s Role- Politics Meets Personal Finance

Donald Trump is expected to actively promote Trump Accounts during tax season, urging families to open them as part of a broader economic vision.

His narrative is clear:

- Empower families, not bureaucracy

- Build wealth early, not late

- Reduce dependence on welfare programs

Supporters argue this could become the biggest savings revolution since 401(k) plans.

Critics argue it’s a political branding exercise.

Public Reaction- Divided America

Positive Opinions 👍

Many Americans see Trump Accounts as a breakthrough.

Common arguments:

- “Finally, a program that rewards saving instead of spending.”

- “This could help middle-class families build real wealth.”

- “Kids starting with $1,000 could change everything.”

Parents are especially interested in long-term benefits for children.

Negative Opinions 👎

Critics raise serious concerns:

- Politicization of banking

- Unequal access for low-income families

- Risk of corporate influence on public policy

- Potential tax burden on future governments

Economists warn:

“If not designed carefully, Trump Accounts could widen the wealth gap instead of closing it.”

Geopolitical Implications- Why the World Is Watching

The Trump Account idea is not just domestic it has global implications.

1) U.S. vs China- Competing Economic Models

China already invests heavily in youth financial programs and state-backed savings initiatives.

If Trump Accounts succeed:

- The U.S. could strengthen its middle class.

- It could counter China’s state-driven wealth-building model.

2) Europe’s Response

European policymakers are watching closely.

Some analysts predict:

- EU countries may introduce similar “child wealth accounts.”

- Global competition for financial innovation could intensify.

Economic Impact- What Could Happen Next?

Short-Term (2026–2027)

- Surge in account openings

- Increased bank participation

- Political debates intensify

- Stock market reacts positively to banking sector growth

Mid-Term (2028–2032)

- Trillions in long-term savings accumulate

- New fintech products emerge

- Government revises tax policies

Long-Term (2035+)

- Structural shift in how Americans build wealth

- Reduced reliance on student loans

- Stronger generational financial stability or deeper inequality

Hidden Risks Most People Don’t See

1) Market Volatility Risk

If Trump Accounts are invested in stocks:

- Market crashes could wipe out savings.

- Families may blame banks or government.

2) Political Risk

A future administration could:

- Cancel or modify the program.

- Change tax rules.

- Reduce government contributions.

3) Social Risk

If only middle-class families benefit:

- Social tensions could rise.

- Critics may label it “wealth welfare.”

lta’s Expert Opinion – Analysis

lta’s Expert Opinion – Analysis

From a strategic perspective, Trump Accounts represent something bigger than a financial product.

They signal:

- A shift from welfare to asset-building policy

- The fusion of politics and fintech

- The rise of “family-focused capitalism”

If implemented wisely, Trump Accounts could become the American equivalent of sovereign wealth funds but for ordinary people.

If mismanaged, they could become another political experiment with unintended consequences.

FAQ’s- Everything You Need to Know About Trump Accounts

1) What is a Trump Account in simple terms?

A government-supported savings or investment account with potential bank matching and tax benefits.

2) Who is eligible for a Trump Account?

Eligibility may include:

- U.S. citizens or residents

- Children under a certain age

- Employees of participating companies

- Families meeting income criteria

Exact rules may vary as legislation evolves.

3) Can kids have Trump Accounts?

Yes. The program is heavily focused on children’s financial futures.

4) Are Trump Accounts mandatory?

No. They are voluntary.

5) Are Trump Accounts tax-free?

They may offer tax advantages, but details depend on final legislation.

6) Are JPMorgan and Bank of America offering them to everyone?

Currently, matching contributions are focused on employees, but broader public programs may follow.

7) Is this a political scheme or real financial innovation?

Both. It combines political branding with genuine financial strategy.

8) Could Trump Accounts replace traditional savings accounts?

Not entirely, but they could become a major alternative.

9) What happens if Trump Accounts fail?

Banks may withdraw support, and the government could redesign or abandon the program.

10) Should families open Trump Accounts now?

Experts suggest waiting for full regulatory clarity before making decisions.

Final Thought- A Turning Point in American Finance?

Trump Accounts may seem like just another policy headline today.

But tomorrow, they could redefine how Americans save, invest, and secure their children’s futures.

Whether this becomes a historic financial revolution or a controversial political experiment will depend on one thing:

👉 How wisely the system is designed and who truly benefits from it.

Table of Contents

- IRS Tax Refund 2026- Bigger Payments Coming for Some, but Delays Loom as Staffing Crisis Deepens

- Marvel’s Wolverine Has Massive Hype – But! Can Insomniac Really Deliver Its Darkest Game Yet? (Feb 2026)

- Fallout Countdown Falls Flat – “This Wasn’t What We Expected’ Fallout Countdown Backlash Erupts Online (Feb 2026)

- Europe Fintech Is Surging Across Europe – But Regulation, War, and Trade Shocks Could Change Everything (Feb 2026)

- Global Stocks Rally Into New Month While Gold Crashes and Global Risk Signals Multiply” (January 2026)

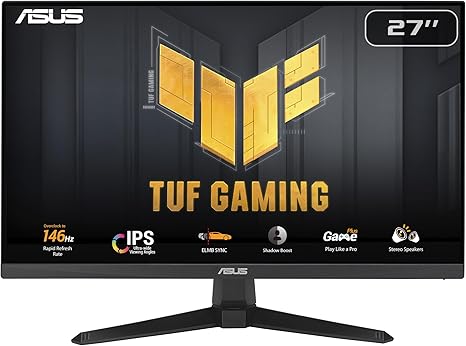

ASUS TUF Gaming 27” 1080P Monitor

| Brand | ASUS |

| Screen Size | 27 Inches |

| Resolution | FHD 1080p |

| Aspect Ratio | 16:9 |

| Screen Surface Description | Matte |

Leave a Reply