Intel Stock Under Pressure- Insider Selling, $40 Resistance, and Why INTC Is Struggling Despite a Rising Market

Intel Corporation (NASDAQ: INTC) is once again at the center of investor debate after Yelin Lapidot Holdings Management Ltd. sold 60,000 Intel shares, while the stock failed to break above the critical $40.05 resistance level. At the same time, broader markets posted gains yet Intel shares moved lower, raising fresh questions about confidence, timing, and Intel’s longer-term outlook amid geopolitical and technological uncertainty.

This article breaks down what really happened, why Intel is underperforming even as markets rise, and what investors should realistically expect next.

Yelin Lapidot’s Intel Share Sale- What We Know

Yelin Lapidot Holdings Management Ltd., a known institutional investor, disclosed the sale of 60,000 shares of Intel, a move that immediately caught market attention.

Why this matters:

- Institutional selling often acts as a psychological signal

- It doesn’t automatically mean loss of faith, but it adds pressure near resistance levels

- The sale occurred while Intel was testing a key technical breakout

Importantly, there has been no indication of panic selling or liquidation of the entire position suggesting portfolio rebalancing rather than abandonment.

The $40.05 Resistance- Why Intel Keeps Stalling

Intel stock has repeatedly failed to sustain momentum above $40–$40.50, a zone traders now view as a major technical wall.

Technical factors holding INTC back:

- Heavy historical trading volume near $40

- Profit-taking from long-term holders

- Weak follow-through buying after earnings updates

- Ongoing uncertainty around Intel’s margin recovery

Each rejection at this level reinforces resistance, making future breakouts harder without a strong catalyst.

Why Intel Fell While the Market Rose

One of the most troubling signals for investors is that Intel sank even as broader indices climbed.

Key reasons:

- Semiconductor competition intensifying

- Execution concerns

- Intel’s turnaround depends on flawless foundry execution

- Macro rotation

- Investors favor high-growth AI winners over turnaround plays

- Geopolitical overhang

Markets reward clarity and momentum two things Intel is still trying to prove.

War, Geopolitics, and Intel’s Strategic Risk

Intel is deeply exposed to geopolitical dynamics, especially as a U.S.-based chip giant positioned at the heart of the semiconductor sovereignty battle.

Geopolitical pressures impacting Intel:

- U.S. export controls limiting China exposure

- Heavy dependence on government incentives (CHIPS Act)

- Rising costs tied to domestic manufacturing

- Supply-chain risks from global conflicts

While these factors support Intel’s long-term strategic importance, they also compress margins in the short term.

Forecast- What Comes Next for INTC?

Short-term (weeks):

- Likely range-bound between $36–$40

- High volatility around earnings or macro data

- Breakout unlikely without strong guidance

Medium-term (2025 outlook):

- Success hinges on:

- Foundry customer wins

- AI-related revenue clarity

- Stable gross margins above 45%

- Failure in execution could push shares lower

Long-term:

Intel remains a strategic asset, but investors must accept slower recovery and higher risk compared to AI leaders.

lta’s Opinion- Caution, Not Capitulation

lta’s Opinion- Caution, Not Capitulation

“Intel is not broken but it is not cheap confidence either.”

Alta believes Intel’s story is still intact, but:

- Insider selling near resistance adds pressure

- Markets want proof, not promises

- Intel must show it can execute faster than competitors evolve

For long-term investors, INTC may still make sense only as a patient, diversified position, not a momentum trade.

Hidden Detail Many Investors Miss

Intel’s biggest challenge isn’t technology it’s timing.

The market rewards companies already monetizing AI, while Intel is still building the infrastructure. This gap explains why even positive news often fails to lift the stock sustainably.

FAQ’s

Q1: Does Yelin Lapidot selling mean Intel is in trouble?

Not necessarily. Institutional sales can reflect portfolio management rather than loss of confidence.

Q2: Why is $40 such a critical level for Intel?

It’s a long-standing resistance zone where sellers consistently overwhelm buyers.

Q3: Can geopolitical tensions help Intel long-term?

Yes, but they also raise costs and limit flexibility in the near term.

Q4: Is Intel a buy right now?

Only for long-term investors with patience and diversified exposure. Traders should be cautious.

Q5: What catalyst could push INTC higher?

Clear foundry contracts, AI revenue growth, or improved margin guidance.

Bottom Line

Intel’s recent slide reflects more than just insider selling. It’s the result of technical resistance, competitive pressure, and geopolitical complexity colliding at the wrong moment.

Until Intel proves it can translate strategy into sustained earnings growth, the stock may continue to stall while markets move on.

Table of Contents

- Resident Evil Requiem Becomes 2026’s Highest-Rated Game – A Survival Horror Masterpiece or an Overhyped Sequel That Loses Steam?

- Black Ops 7 Sets a New Standard for Tactical FPS Combat – But Controversy and Matchmaking Frustrations Spark Debate

- Ghostrunner 2 Free on Epic Games, A Cyberpunk Masterpiece of Relentless Action – or a Brutally Punishing Game That’s Too Hard to Love?

- Code Vein II Is a Beautiful Evolution – But Its Uneven World Holds It Back! Or Does It Still Lack the Crown? (Feb 2026)

- Nioh 3 Review- A Brutal Soulslike Masterpiece That Perfects Samurai Combat – Or an Unforgiving Grind That Pushes Players Too Far?

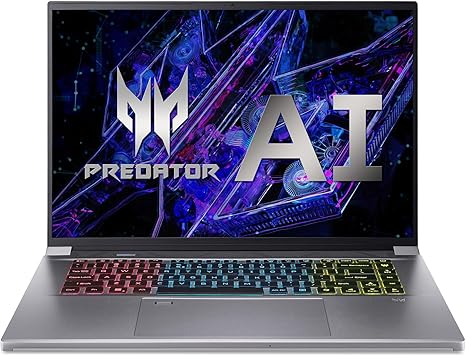

Acer Predator Triton Neo 16 Gaming Creator Laptop

| Brand | acer |

| Model Name | Acer Predator Triton Neo 16 Gaming Creator Laptop |

| Screen Size | 16 Inches |

| Color | Silver |

| Hard Disk Size | 1 TB |

| CPU Model | Intel Core i9 |

| Ram Memory Installed Size | 32 GB |

| Operating System | Windows 11 Home |

| Special Feature | Backlit Keyboard, Fingerprint Reader, Memory Card Slot |

| Graphics Card Description |

Leave a Reply